Contents

- 1 Introduction

- 2 Foreign Trade

- 3 Foreign Investment

- 4 Differences between Foreign Trade and Foreign Investment

- 5 Summary

- 6 FAQs

- 6.1 What is Foreign trade?

- 6.2 What is Foreign investment?

- 6.3 How do Foreign trade and foreign investment differ?

- 6.4 What are the benefits of foreign trade?

- 6.5 What are the benefits of foreign investment?

- 6.6 What are some examples of foreign trade?

- 6.7 What are some examples of foreign investment?

- 6.8 What are the risks associated with foreign trade and foreign investment?

- 6.9 Can a company engage in both foreign trade and foreign investment?

Learn about the differences between foreign trade and foreign investment, two important concepts in international business. Learn about the benefits and risks associated with each, and how companies can engage in both to expand their global reach. In this article, we will explore the difference between foreign trade and foreign investment, their definitions, characteristics, examples, and how they affect the economy.

Introduction

International economic transactions have become increasingly important in the global economy. Foreign trade and foreign investment are two of the most important forms of international economic transactions. Although they are often used interchangeably, there are significant differences between these two terms.

Foreign Trade

Foreign trade is the exchange of goods and services between two or more countries. This includes exports, imports, and re-exports. Exporting is the process of selling goods and services produced in one country to another country, while importing is buying goods and services produced in another country for use in one’s own country. Re-exporting is the process of buying goods and services from one country and then selling them to another country without any alteration.

Characteristics of Foreign Trade

Foreign trade is characterized by the following features:

1. Specialization: Each country specializes in producing goods and services that it can produce efficiently and at a lower cost than other countries.

2. Balance of trade: The balance of trade refers to the difference between a country’s exports and imports. If a country exports more than it imports, it has a trade surplus, and if it imports more than it exports, it has a trade deficit.

3. Comparative advantage: Comparative advantage refers to the ability of a country to produce a good or service at a lower opportunity cost than other countries.

Examples of Foreign Trade

Some examples of foreign trade include:

- An American company importing raw materials from China to manufacture goods in the US for export to other countries.

- A German company exporting luxury cars to the US market.

Foreign Investment

Foreign investment is the transfer of capital, resources, or technology from one country to another. This includes investments in stocks, bonds, real estate, and direct investment. Direct investment is the ownership or control of a foreign company, while portfolio investment refers to investments in stocks or bonds of foreign companies.

Characteristics of Foreign Investment

Foreign investment is characterized by the following features:

1. Risk and return: Foreign investment involves greater risk and potential returns than domestic investment due to political, economic, and cultural factors.

2. Capital flow: Foreign investment involves the transfer of capital from one country to another, either in the form of equity or debt.

3. Ownership: Foreign investment involves ownership or control of foreign assets, such as companies, real estate, and intellectual property.

Examples of Foreign Investment

Some examples of foreign investment include:

- A Japanese company investing in a manufacturing plant in the US to access the American market.

- A Saudi Arabian investor purchasing a luxury hotel in France to diversify their investment portfolio.

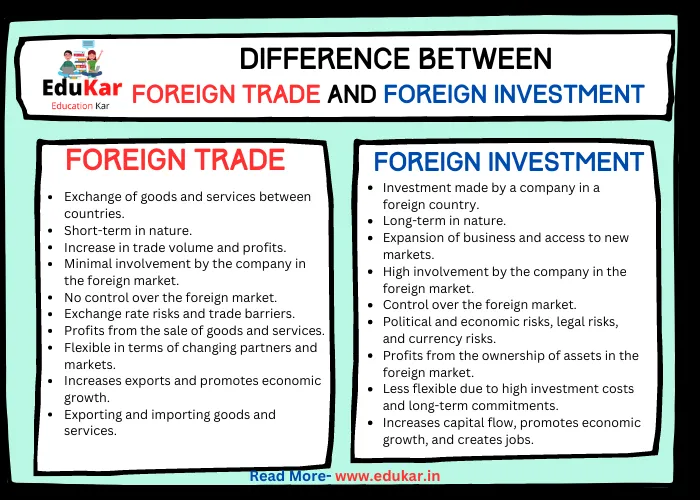

Differences between Foreign Trade and Foreign Investment

| Differences | Foreign Trade | Foreign Investment |

|---|---|---|

| Definition | Exchange of goods and services between countries | Investment made by a company in a foreign country |

| Nature | Short-term in nature | Long-term in nature |

| Purpose | Increase in trade volume and profits | Expansion of business and access to new markets |

| Level of involvement | Minimal involvement by the company in the foreign market | High involvement by the company in the foreign market |

| Control | No control over the foreign market | Control over the foreign market |

| Risks | Exchange rate risks and trade barriers | Political and economic risks, legal risks, and currency risks |

| Type of income | Profits from the sale of goods and services | Profits from the ownership of assets in the foreign market |

| Flexibility | Flexible in terms of changing partners and markets | Less flexible due to high investment costs and long-term commitments |

| Economic benefits | Increases exports and promotes economic growth | Increases capital flow, promotes economic growth, and creates jobs |

| Examples | Exporting and importing goods and services | Establishing a subsidiary, joint venture, or acquiring a company in a foreign market |

Key Differences between Foreign Trade and Foreign Investment in Points:

1. Purpose: Foreign trade is primarily focused on the exchange of goods and services, while foreign investment is focused on the transfer of capital, resources, or technology.

2. Nature of the transaction: Foreign trade involves the exchange of goods and services between countries, while foreign investment involves the ownership or control of foreign assets.

3. Timing: Foreign trade transactions are typically short-term, while foreign investment transactions are long-term.

4. Risks and returns: Foreign trade transactions involve lower risks and returns compared to foreign investment, which involves greater risks and potential returns.

5. Influence on the economy: Foreign trade can influence a country’s balance of payments, while foreign investment can influence a country’s economic growth and development.

Summary

Foreign trade and foreign investment are two important forms of international economic transactions. Understanding the differences between these two terms is crucial for policymakers, investors, and business leaders to make informed decisions and maximize the benefits of international trade and investment. Ultimately, the success of a country’s foreign trade and investment policies depends on a combination of sound economic policies and good governance.

FAQs

What is Foreign trade?

Foreign trade is the exchange of goods and services between different countries. It can include both imports and exports and can be conducted by individuals, companies, or governments.

What is Foreign investment?

Foreign investment is the investment of capital or resources by a foreign entity into a host country’s economy. It can include investments in companies, real estate, or other assets and can be made by individuals, companies, or governments.

How do Foreign trade and foreign investment differ?

Foreign trade involves the exchange of goods and services across borders, while foreign investment involves the investment of capital or resources into a foreign country’s economy. Foreign trade is typically conducted on a transaction-by-transaction basis, while foreign investment involves a longer-term commitment to a foreign market.

What are the benefits of foreign trade?

Foreign trade can lead to increased economic growth, job creation, and consumer choice. It can also help countries access goods and services that they may not be able to produce domestically.

What are the benefits of foreign investment?

Foreign investment can provide capital and expertise to a host country’s economy, leading to increased economic growth and job creation. It can also facilitate the transfer of technology and knowledge between countries.

What are some examples of foreign trade?

Examples of foreign trade include exporting goods to another country, importing goods from another country, and participating in international trade agreements such as the World Trade Organization.

What are some examples of foreign investment?

Examples of foreign investment include buying stock in a foreign company, investing in real estate in a foreign country, and establishing a subsidiary or branch office in a foreign market.

What are the risks associated with foreign trade and foreign investment?

Risks associated with foreign trade and foreign investment can include changes in currency exchange rates, political instability, and legal and regulatory barriers in foreign markets.

Can a company engage in both foreign trade and foreign investment?

Yes, a company can engage in both foreign trade and foreign investment. In fact, many companies that engage in foreign trade also invest in foreign markets to expand their operations and increase their global reach.