Contents

- 1 Introduction

- 2 Capital Receipts

- 3 Revenue Receipts

- 4 Differences between Capital Receipts and Revenue Receipts

- 5 Conclusion

- 6 FAQs:

- 6.1 What are capital receipts?

- 6.2 What are revenue receipts?

- 6.3 What is the difference between capital receipts and revenue receipts?

- 6.4 How are capital receipts and revenue receipts treated in accounting?

- 6.5 Can capital receipts be converted into revenue receipts?

- 6.6 Can revenue receipts be converted into capital receipts?

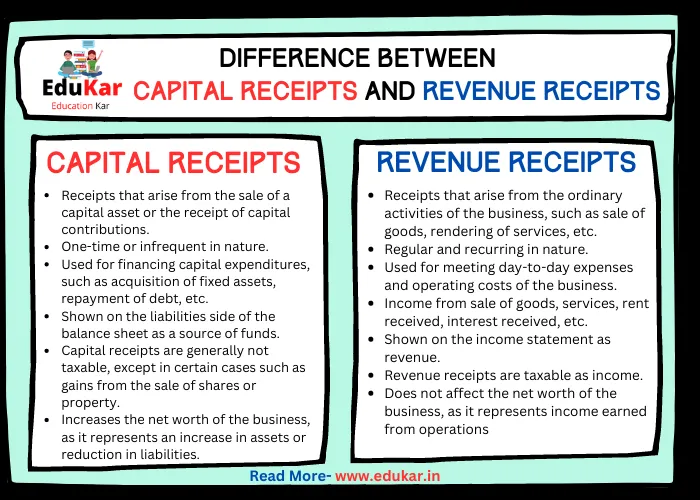

Learn about the differences between Capital Receipts and Revenue Receipts in this comprehensive guide. Understand how these receipts affect the financial position of a business, how they are treated in accounting, and examples of each type. Get clarity on the distinction between these two types of receipts to better manage your finances.

Introduction

When it comes to accounting, understanding the difference between capital receipts and revenue receipts is important for businesses of all sizes. Capital receipts and revenue receipts are two distinct types of receipts that impact a company’s financial health in different ways.

Capital Receipts

Capital receipts are defined as receipts that are generated through the sale of a company’s assets or investments. Capital receipts are typically one-time receipts, and they do not affect a company’s day-to-day operations. Instead, they are focused on long-term growth and development.

Some examples of capital receipts include:

- Sale of land or property

- Sale of investments or securities

- Receipts from long-term loans

- Capital contributions from shareholders

The impact of capital receipts is reflected in a company’s balance sheet, where they are recorded as an increase in the company’s equity. Capital receipts can be an important source of funding for a company’s long-term investments and expansion plans.

Revenue Receipts

Revenue receipts, on the other hand, are receipts generated through a company’s day-to-day operations. These receipts are recurring and are necessary for a company’s continued operations.

Examples of revenue receipts include:

- Sales revenue

- Service fees

- Interest income

- Rent income

Revenue receipts are reflected in a company’s income statement, where they are recorded as revenue. Revenue receipts are important for a company’s short-term financial stability and are necessary for meeting day-to-day expenses.

Differences between Capital Receipts and Revenue Receipts

| Capital Receipts | Revenue Receipts | |

|---|---|---|

| Definition | Receipts that arise from the sale of a capital asset or the receipt of capital contributions | Receipts that arise from the ordinary activities of the business, such as sale of goods, rendering of services, etc. |

| Nature | One-time or infrequent in nature | Regular and recurring in nature |

| Purpose | Used for financing capital expenditures, such as acquisition of fixed assets, repayment of debt, etc. | Used for meeting day-to-day expenses and operating costs of the business |

| Examples | Proceeds from sale of land, buildings, machinery, or shares | Income from sale of goods, services, rent received, interest received, etc. |

| Accounting treatment | Shown on the liabilities side of the balance sheet as a source of funds | Shown on the income statement as revenue |

| Tax treatment | Capital receipts are generally not taxable, except in certain cases such as gains from the sale of shares or property | Revenue receipts are taxable as income |

| Impact on financial position | Increases the net worth of the business, as it represents an increase in assets or reduction in liabilities | Does not affect the net worth of the business, as it represents income earned from operations |

| Duration of impact | Has a long-term impact on the financial position of the business | Has a short-term impact on the financial position of the business |

| Role in capital budgeting | Important for assessing the long-term financial viability of the business | Not directly related to capital budgeting decisions |

| Sources | Sales of assets, capital contributions, loans taken for capital purposes, etc. | Sales of goods, rendering of services, rent received, interest received, etc. |

Key differences between capital receipts and revenue receipts:

Basis of classification: Capital receipts are classified based on their long-term impact on a company’s financial health, while revenue receipts are classified based on their short-term impact.

Nature of receipts: Capital receipts are generated through the sale of assets or investments, while revenue receipts are generated through a company’s day-to-day operations.

Time horizon of impact: Capital receipts have a long-term impact on a company’s financial health, while revenue receipts have a short-term impact.

Treatment in financial statements: Capital receipts are recorded in a company’s balance sheet, while revenue receipts are recorded in a company’s income statement.

Conclusion

Capital receipts and revenue receipts are two distinct types of receipts that impact a company’s financial health in different ways. Capital receipts are focused on long-term growth and development, while revenue receipts are necessary for short-term financial stability.

Understanding the difference between the two is important for making strategic decisions, proper financial reporting, and tax planning and compliance. By understanding the differences between capital receipts and revenue receipts, companies can better manage their finances and achieve their long-term goals.

FAQs:

What are capital receipts?

Capital receipts refer to the receipts of a capital nature that result in an increase in the capital assets or a decrease in the capital liabilities of a business or organization. Examples of capital receipts include the sale of fixed assets, capital contribution by owners, long-term borrowings, and proceeds from the issue of share capital.

What are revenue receipts?

Revenue receipts refer to the receipts of a revenue nature that do not result in an increase in the capital assets or a decrease in the capital liabilities of a business or organization. Examples of revenue receipts include sales revenue, interest received on investments, rent received, and proceeds from the sale of stock-in-trade.

What is the difference between capital receipts and revenue receipts?

The main difference between capital receipts and revenue receipts is that capital receipts are receipts of a capital nature, which affect the long-term financial position of a business or organization, while revenue receipts are receipts of a revenue nature, which affect the short-term financial position of a business or organization.

How are capital receipts and revenue receipts treated in accounting?

Capital receipts are shown on the liabilities side of the balance sheet, while revenue receipts are shown on the income side of the income statement. Capital receipts are not considered as income, and therefore, are not subject to income tax, while revenue receipts are subject to income tax.

Can capital receipts be converted into revenue receipts?

Yes, it is possible to convert capital receipts into revenue receipts. For example, if a business sells a fixed asset, the proceeds from the sale would be considered as a capital receipt. However, if the business invests the proceeds from the sale in a short-term investment, the interest earned on the investment would be considered as a revenue receipt.

Can revenue receipts be converted into capital receipts?

No, revenue receipts cannot be converted into capital receipts, as they do not result in an increase in the capital assets or a decrease in the capital liabilities of a business or organization.