Contents

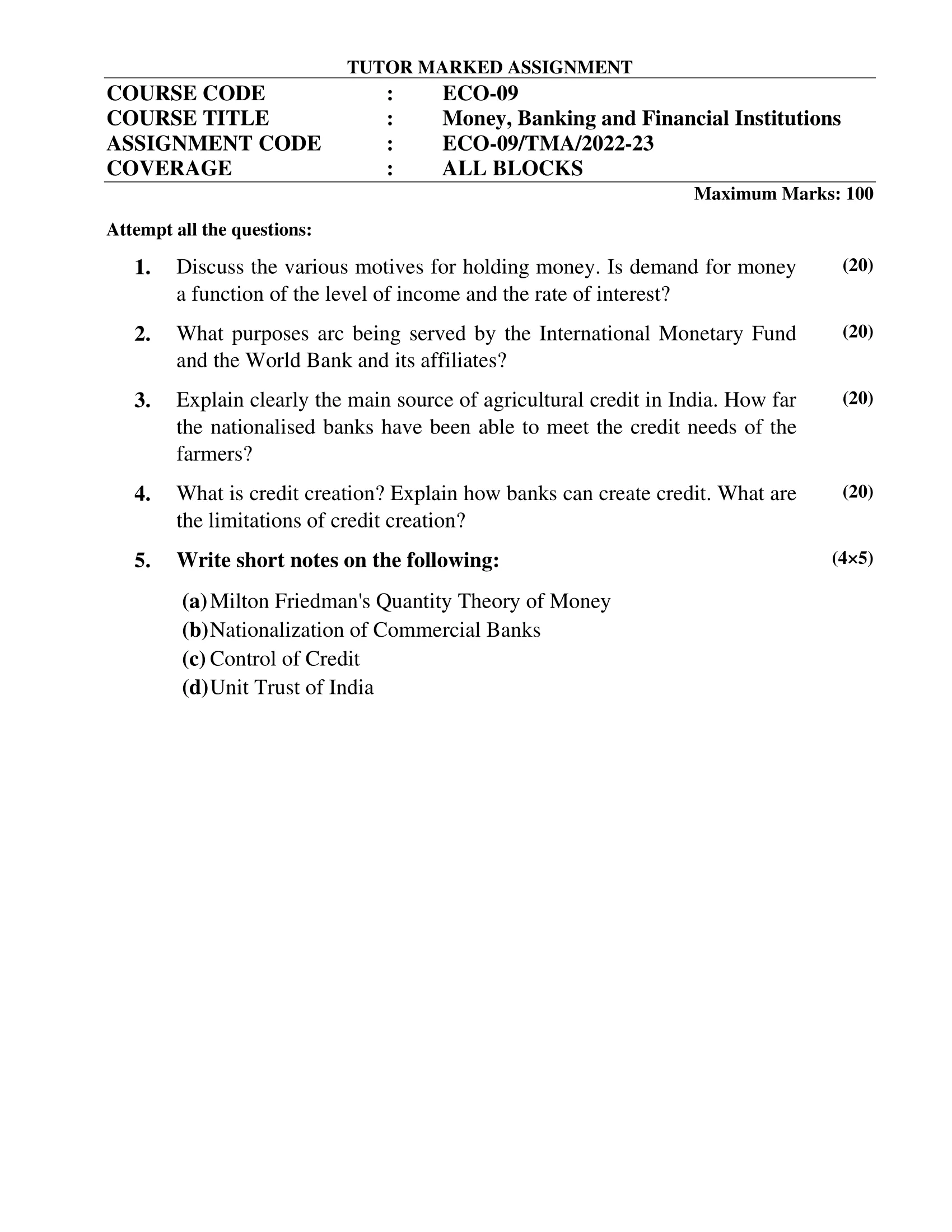

- 1 1. Discuss the various motives for holding money. Is demand for moneya function of the level of income and the rate of interest?

- 2 2. What purposes arc being served by the International Monetary Fundand the World Bank and its affiliates?

- 3 3. Explain clearly the main source of agricultural credit in India. How farthe nationalised banks have been able to meet the credit needs of thefarmers?

- 4 4. What is credit creation? Explain how banks can create credit. What arethe limitations of credit creation?

- 5 5. Write short notes on the following:

- 6 (a) Milton Friedman’s Quantity Theory of Money

- 7 (b) Nationalization of Commercial Banks

- 8 (c) Control of Credit

- 9 (d) Unit Trust of India

\

| Title | ECO-09: IGNOU B.Com Solved Assignment 2022-2023 |

| University | IGNOU |

| Degree | Bachelor Degree Programme |

| Course Code | ECO-09 |

| Course Name | Money, Banking and Financial Institutions |

| Programme Name | B.Com |

| Programme Code | BDP |

| Total Marks | 100 |

| Year | 2022-2023 |

| Language | English |

| Assignment Code | ECO-09/TMA/2022-23 |

| Assignment PDF | Click Here |

| Last Date for Submission of Assignment: | For June Examination: 31st April For December Examination: 30th September |

1. Discuss the various motives for holding money. Is demand for money

a function of the level of income and the rate of interest?

Ans: Money is an essential part of the economy as it serves as a medium of exchange, unit of account, and store of value. People hold money for various reasons, including transactions, precautionary, speculative, and portfolio motives.

- Transactions motive: People hold money to carry out daily transactions such as buying goods and services. The amount of money held for this motive depends on the level of income, the frequency of transactions, and the transaction costs involved.

- Precautionary motive: People hold money for unexpected expenses or emergencies. The amount of money held for this motive depends on the level of income and the uncertainty surrounding the future income and expenses.

- Speculative motive: People hold money to take advantage of investment opportunities that may arise in the future. The amount of money held for this motive depends on the expected return on investment and the risk involved.

- Portfolio motive: People hold money to diversify their portfolio of assets. The amount of money held for this motive depends on the expected return and risk of other assets such as stocks, bonds, and real estate.

The demand for money is influenced by both the level of income and the rate of interest. The higher the level of income, the higher the transactions and precautionary demand for money. The speculative and portfolio motives are also affected by the level of income, but the relationship may not be direct.

The demand for money is inversely related to the rate of interest. When the rate of interest is high, the opportunity cost of holding money increases, leading to a decrease in the demand for money. On the other hand, when the rate of interest is low, the opportunity cost of holding money decreases, leading to an increase in the demand for money.

2. What purposes arc being served by the International Monetary Fund

and the World Bank and its affiliates?

Ans: The International Monetary Fund (IMF) and the World Bank are two important international organizations that were created to help promote international economic cooperation and development. They have several affiliates that carry out their work in different areas. Here are some of the purposes served by these institutions:

- The IMF provides short-term loans and financial assistance to member countries that are facing balance of payments difficulties. It also provides policy advice and technical assistance to help countries strengthen their economic policies and institutions.

- The World Bank and its affiliates provide long-term loans and grants to developing countries to support their economic development and poverty reduction efforts. The World Bank focuses on financing projects in areas such as infrastructure, agriculture, health, and education.

- The International Finance Corporation (IFC), which is a part of the World Bank Group, provides financing to private sector businesses in developing countries. It helps to mobilize private capital and supports the growth of small and medium-sized enterprises.

- The Multilateral Investment Guarantee Agency (MIGA), which is also a part of the World Bank Group, provides political risk insurance to investors in developing countries. This helps to encourage foreign investment and promotes economic growth.

- The World Bank also conducts research and analysis on economic and social issues facing developing countries. It produces reports, data, and analysis that can inform policy decisions at the national and international levels.

3. Explain clearly the main source of agricultural credit in India. How far

the nationalised banks have been able to meet the credit needs of the

farmers?

Ans: The main sources of agricultural credit in India are formal institutional sources, which include commercial banks, regional rural banks (RRBs), and cooperative banks. Of these, the nationalized banks have been the largest providers of agricultural credit in the country.

The nationalized banks in India were directed by the government to prioritize agricultural credit, which led to the establishment of specialized agricultural credit branches in these banks. These branches provide agricultural credit to farmers for various purposes, such as crop production, farm mechanization, land development, and working capital needs.

In addition, the Reserve Bank of India (RBI) has set targets for banks to increase their lending to agriculture and allied sectors. Banks are required to ensure that a minimum of 18% of their total advances are directed towards agriculture and allied sectors.

Despite these efforts, there are still challenges in meeting the credit needs of farmers in India. Many farmers lack adequate collateral and credit history, which makes it difficult for them to access formal credit. As a result, they may be forced to borrow from informal sources, such as moneylenders, at high interest rates.

Furthermore, the distribution of agricultural credit is uneven across regions and crops. Some regions and crops receive a larger share of credit than others, which can lead to disparities in agricultural production and incomes.

In recent years, the government has introduced various measures to improve the availability of credit to farmers, such as interest subvention schemes and debt waiver programs. However, there is still a need for further reforms to strengthen the formal agricultural credit system in India and ensure that credit is more accessible to all farmers, regardless of their location or crop choice.

4. What is credit creation? Explain how banks can create credit. What are

the limitations of credit creation?

Ans: Credit creation is the process by which banks and other financial institutions create new money in the economy by lending to borrowers. When a bank makes a loan, it creates a deposit in the borrower’s account, which can then be used to make purchases and payments. This new deposit is a form of money, which increases the total money supply in the economy.

Banks can create credit in several ways:

- Fractional reserve banking: Banks are required to hold a fraction of their deposits as reserves, but they can lend out the remainder. This creates new deposits and expands the money supply.

- Discounting: Banks can also borrow from the central bank by discounting their eligible securities. This increases the reserves of the banks, allowing them to create more credit.

- Open market operations: Banks can also buy and sell government securities in the open market, which affects the reserves of the banks and their ability to create credit.

However, there are limitations to credit creation:

- Capital adequacy requirements: Banks are required to maintain a certain amount of capital to absorb losses. If a bank’s losses exceed its capital, it may be unable to continue lending and creating credit.

- Liquidity requirements: Banks are required to maintain a certain amount of liquid assets to meet the demand for withdrawals by depositors. If a bank does not have enough liquid assets, it may be unable to continue lending and creating credit.

- Creditworthiness of borrowers: Banks need to ensure that the borrowers they lend to are creditworthy and able to repay the loans. If borrowers default on their loans, it can lead to losses for the bank and reduce its ability to create credit.

- Regulatory restrictions: Banks are subject to various regulatory restrictions, such as interest rate caps and sectoral lending limits, which can limit their ability to create credit in certain sectors or at certain rates.

5. Write short notes on the following:

(a) Milton Friedman’s Quantity Theory of Money

Ans: Milton Friedman’s Quantity Theory of Money states that the quantity of money in circulation in an economy has a direct relationship with the overall level of prices. Specifically, if the money supply increases faster than the growth in the economy’s output, prices will rise.

Friedman’s theory argues that the demand for money is relatively stable, meaning that changes in the supply of money will result in corresponding changes in the velocity of money – the rate at which money changes hands. Therefore, an increase in the money supply should lead to an increase in the overall level of prices.

The Quantity Theory of Money has been criticized for its simplistic assumptions and its failure to account for other important factors that can affect the relationship between money supply and price levels, such as changes in consumer preferences, technological progress, and international trade. Nonetheless, the theory has had a significant influence on monetary policy and has helped shape modern macroeconomic thinking.

(b) Nationalization of Commercial Banks

Ans: Nationalization of commercial banks refers to the process of bringing privately-owned banks under the control and ownership of the government. This can be done through various means, such as purchasing the shares of the banks or by enacting laws that require the transfer of ownership.

The primary motivation for nationalization is to exert greater control over the banking sector and to use it as a tool for economic development. Governments may believe that private banks prioritize profit over the needs of the public and may not always act in the best interest of the country as a whole. Nationalization can provide greater oversight and regulation of the banking industry, ensuring that it is aligned with national economic goals.

Nationalization can also lead to the provision of banking services to previously underserved or neglected areas, as governments may prioritize the provision of financial services to such areas as a means of promoting economic development and reducing inequality.

However, nationalization is not without its drawbacks. Critics argue that nationalized banks can become bureaucratic and inefficient, and that they may be used for political purposes rather than for the benefit of the economy. Additionally, nationalization can lead to a lack of competition in the banking sector, which can result in reduced innovation and poorer service quality for customers.

(c) Control of Credit

Ans: The control of credit refers to the various measures taken by governments and central banks to influence the supply and cost of credit within an economy. Credit control policies can affect the availability of credit to individuals and businesses, the level of interest rates, and the overall health of the economy.

Central banks are typically responsible for implementing credit control policies. One key policy tool is the setting of interest rates. By increasing or decreasing interest rates, central banks can influence the demand for credit, and therefore its supply. When interest rates are high, borrowing becomes more expensive, leading to a decrease in demand for credit. Conversely, when interest rates are low, borrowing becomes more attractive, leading to an increase in demand for credit.

Central banks may also use other policy tools, such as reserve requirements, open market operations, and quantitative easing, to influence the supply of credit. Reserve requirements refer to the amount of money that banks are required to hold in reserve, which affects the amount of money they can lend out. Open market operations involve the buying and selling of government securities in order to affect the level of reserves in the banking system. Quantitative easing involves the creation of new money by the central bank to increase the money supply and stimulate lending.

The aim of credit control policies is to ensure that the supply and cost of credit are aligned with the needs of the economy. For example, during times of economic growth, credit may be made more readily available to support investment and consumption. Conversely, during times of inflation, credit may be restricted in order to control the money supply and prevent prices from rising too quickly.

However, the use of credit control policies is not without its risks. Inappropriate policies or poor implementation can lead to unintended consequences, such as asset bubbles or financial instability. Therefore, credit control policies need to be carefully considered and implemented within a broader framework of economic policy.

(d) Unit Trust of India

Ans: The Unit Trust of India (UTI) is a mutual fund company that was established in 1963 by the Government of India. The purpose of UTI was to promote the culture of savings and investment among Indian citizens and to mobilize small savings for national development.

UTI was initially set up as a statutory corporation and was responsible for managing a range of investment schemes, including equity funds, debt funds, and balanced funds. These schemes were designed to appeal to a wide range of investors, from individual savers to institutional investors.

Over the years, UTI has played a significant role in the growth of the Indian mutual fund industry. In 1992, UTI launched India’s first equity-linked savings scheme, which allowed investors to receive tax benefits while investing in the stock market. In 2003, UTI was restructured into a mutual fund company, and its assets were divided among four separate entities.

Today, UTI is one of the largest mutual fund companies in India, with a wide range of investment schemes designed to meet the needs of different types of investors. These schemes include equity funds, debt funds, hybrid funds, and exchange-traded funds (ETFs).

UTI has a long history of promoting financial literacy and investor education in India. The company has conducted numerous investor awareness programs and has launched several initiatives to encourage people to save and invest for their future.

How to Download ECO-09 Solved Assignment?

You can download it from the www.edukar.in, they have a big database for all the IGNOU solved assignments.

Is the ECO-09 Solved Assignment Free?

Yes this is absolutely free to download the solved assignment from www.edukar.in

What is the last submission date for ECO-09 Solved Assignment?

For June Examination: 31st April, For December Examination: 30th October