| Title | ECO-11: IGNOU B.Com Solved Assignment 2022-2023 |

| University | IGNOU |

| Degree | Bachelor Degree Programme |

| Course Code | ECO-11 |

| Course Name | ELEMENTS OF INCOME TAX |

| Programme Name | B.Com |

| Programme Code | BDP |

| Total Marks | 100 |

| Year | 2022-2023 |

| Language | English |

| Assignment Code | ECO-11/TMA/2022-23 |

| Assignment PDF | Click Here |

| Last Date for Submission of Assignment: | For June Examination: 31st April For December Examination: 30th September |

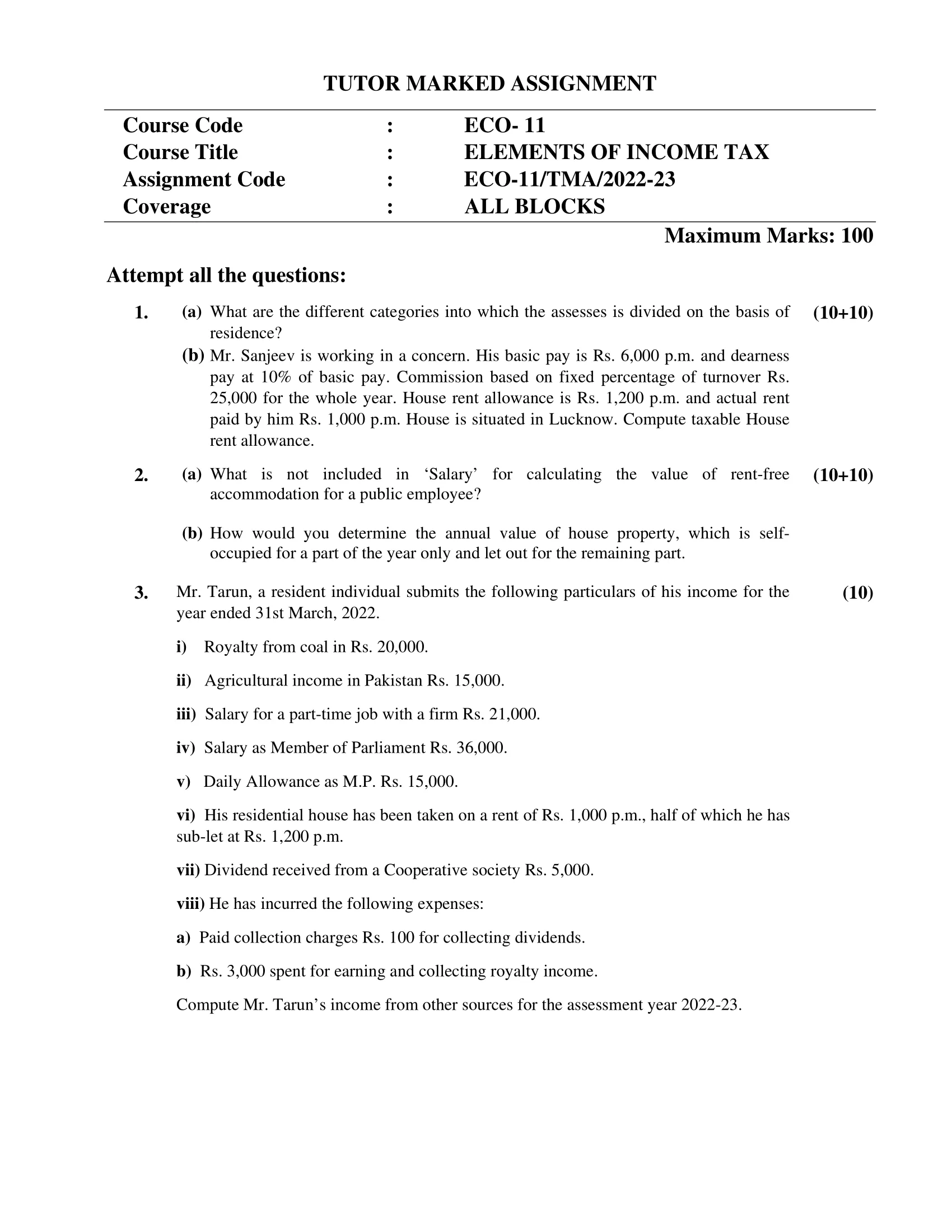

1. (a) What are the different categories into which the assesses is divided on the basis of residence?

Ans: Assesses can be classified into different categories on the basis of their residence. The categories are as follows:

- Resident Assessee: An individual who has resided in India for a minimum of 182 days in the financial year is considered a resident assessee. Additionally, if an individual has resided in India for 60 days or more in the financial year and has resided in India for a total of 365 days or more in the four years prior to the financial year, they are also considered a resident assessee.

- Non-Resident Assessee: An individual who has not resided in India for a minimum of 182 days in the financial year is considered a non-resident assessee.

- Not–Ordinarily Resident (NOR) Assessee: An individual who has been a non-resident in India for nine out of the ten previous years preceding the financial year, or has resided in India for a total of 729 days or less in the seven previous years preceding the financial year, is considered a NOR assessee. NOR assesses are taxed differently from resident and non-resident assesses, as their global income is not taxed in India.

It is important to note that the categorization of an assessee as a resident or non-resident is significant for tax purposes, as the tax rates and exemptions differ for each category.

(b) Mr. Sanjeev is working in a concern. His basic pay is Rs. 6,000 p.m. and dearness pay at 10% of basic pay. Commission based on fixed percentage of turnover Rs. 25,000 for the whole year. House rent allowance is Rs. 1,200 p.m. and actual rent paid by him Rs. 1,000 p.m. House is situated in Lucknow. Compute taxable House rent allowance.

Ans: To calculate the taxable House Rent Allowance(HRA) for Mr. Sanjeev, we need to consider the following information:

Basic pay: Rs. 6,000 per month

Dearness pay: 10 % of basic pay (Rs. 600)

Commission: Rs. 25,000 per year

House Rent Allowance (HRA) Rs. 1,200 per month

Actual rent paid: Rs. 1,000 per month

House location: Lucknow

First, let’s calculate the total salary of Mr. Sanjeev:

Basic pay: Rs. 6,000 per month x 12 months = Rs. 72,000 per year

Dearness pay: Rs. 600 per month x 12 months = Rs. 7,200 per year

Commission: Rs. 7,200 + Rs. 25,000 = Rs. 1,04,200 per year

Next, let’s calculate the taxable HRA:

The taxable HRA is the minimum of the following:

Actual HRA received (Rs. 1,200 per month x 12 months = Rs. 14,400 per year) 40 % of the total salary (for those living in a metropolitan city like lucknow) (Rs. 40% x Rs. 1,04,200 = Rs. 41,680 per year)

Actual rent paid minus 10% of the basic salary (Rs. 1,000 per month – 10% of Rs. 6,000 = Rs. 400) x 12 months = Rs. 4,800 per year

The taxable HRA will be Rs. 4,800, which is the minimum of the above three values.

Therefore, the taxable HRA for Mr. Sanjeev will be Rs. 4,800 per year. This amount will be added to his total salary for tax calculation purposes.

2. (a) What is not included in ‘Salary’ for calculating the value of rent-free accommodation for a public employee?

Ans: The value of rent-free accommodation for a public employee typically includes the fair market rental value of the accommodation provided by the employer. However, certain elements are not included in the calculation of the value of rent-free accommodation, such as:

- Utility Bills: If the employer pays for the utility bills, such as electricity, gas, water, or internet, those amounts are not included in the calculation of the value of rent-free accommodation.

- Maintenance and Repair Costs: The employer is responsible for maintaining and repairing the accommodation, and these costs are not included in the calculation of the value of rent-free accommodation.

- Furniture and Appliances: If the accommodation is furnished by the employer, the value of the furniture and appliances is not included in the calculation of the value of rent-free accommodation.

- Property Taxes: The employer is responsible for paying the property taxes on the accommodation, and these amounts are not included in the calculation of the value of rent-free accommodation.

(b) How would you determine the annual value of house property, which is selfoccupied for a part of the year only and let out for the remaining part.

Ans: The determination of the annual value of a house property that is self-occupied for part of the year and let out for the remaining part involves a combination of factors, including the rental income earned and the period of self-occupation.

Here are the steps to determine the annual value of such a property:

- Calculate the rental income earned during the period when the property is let out. This can be calculated by multiplying the monthly rent received by the number of months the property is rented out.

- Determine the period of self-occupation. This can be calculated by subtracting the period of let-out from the total period of the year.

- Calculate the deemed rent for the period of self-occupation. The deemed rent is calculated as per the provisions of the Income Tax Act. As per Section 23(1)(a), the deemed rent for self-occupied property is considered to be nil. Therefore, for the period of self-occupation, the annual value of the property is zero.

- Calculate the deemed rent for the period when the property is let out. The deemed rent is calculated as per the provisions of the Income Tax Act. As per Section 23(1)(b), the deemed rent for let-out property is the actual rent received or the fair rent, whichever is higher.

- Add the deemed rent for the let-out period to the actual rent received for the same period. This will give the total annual value of the property.

For example, if a house property is let out for 6 months and self-occupied for the remaining 6 months of the year, and the monthly rent received during the let-out period is Rs. 20,000, the annual value of the property would be calculated as follows:

Annual value = (6 months x Rs. 20,000) + (6 months x 0) = Rs. 1,20,000

So, the annual value of the property would be Rs. 1,20,000.

3. Mr. Tarun, a resident individual submits the following particulars of his income for the year ended 31st March, 2022.

i) Royalty from coal in Rs. 20,000.

Ans: Royalty from coal in Rs. 20,000: This income will be taxable under the head “Income from Other Sources”.

ii) Agricultural income in Pakistan Rs. 15,000.

Ans: Agricultural income in Pakistan Rs. 15,000: Agricultural income is exempt from income tax in India.

iii) Salary for a part-time job with a firm Rs. 21,000.

Ans: Salary for a part-time job with a firm Rs. 21,000: This income will be taxable under the head “Income from Salaries”.

iv) Salary as Member of Parliament Rs. 36,000.

Ans: Salary as Member of Parliament Rs. 36,000: This income will be taxable under the head “Income from Salaries”.

v) Daily Allowance as M.P. Rs. 15,000.

Ans: Daily Allowance as M.P. Rs. 15,000: This income will be taxable under the head “Income from Other Sources”.

vi) His residential house has been taken on a rent of Rs. 1,000 p.m., half of which he has sub-let at Rs. 1,200 p.m.

Ans: His residential house has been taken on a rent of Rs. 1,000 p.m., half of which he has sub-let at Rs. 1,200 p.m.: Rental income from sub-letting will be taxable under the head “Income from House Property”.

vii) Dividend received from a Cooperative society Rs. 5,000.

Ans: Dividend received from a Cooperative society Rs. 5,000: Dividend income is taxable under the head “Income from Other Sources”.

viii) He has incurred the following expenses:

a) Paid collection charges Rs. 100 for collecting dividends.

Ans: Paid collection charges Rs. 100 for collecting dividends: This expense can be claimed as a deduction under the head “Income from Other Sources”.

b) Rs. 3,000 spent for earning and collecting royalty income.

Ans: Rs. 3,000 spent for earning and collecting royalty income: This expense can be claimed as a deduction under the head “Income from Other Sources” since it was incurred for earning the royalty income. However, it’s important to ensure that the expenses were actually incurred and are supported by proper receipts or documentation.

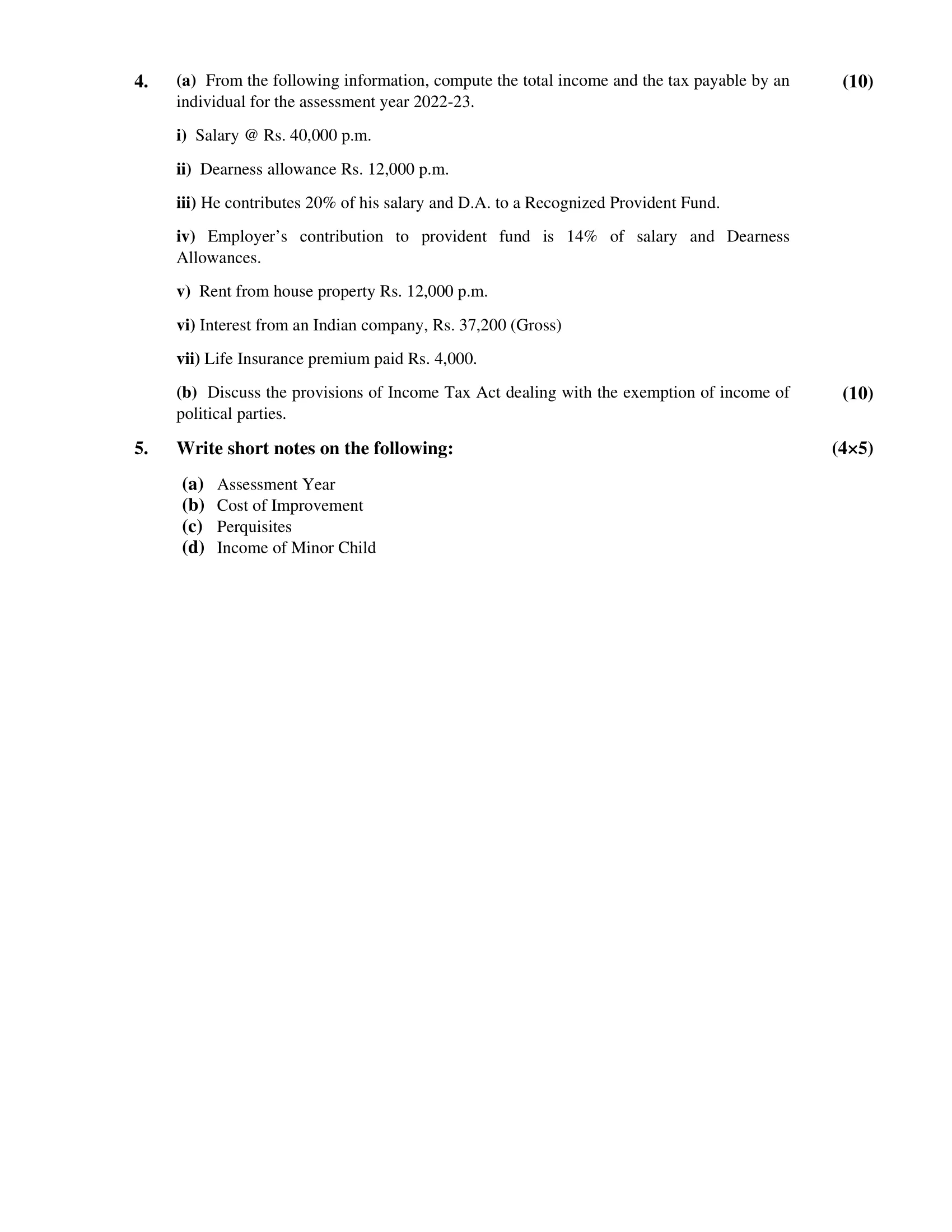

4. (a) From the following information, compute the total income and the tax payable by an individual for the assessment year 2022-23.

i) Salary @ Rs. 40,000 p.m.

Ans: Salary @ Rs. 40,000 p.m.: Rs. 40,000 x 12 = Rs. 4,80,000

ii) Dearness allowance Rs. 12,000 p.m.

Ans: Dearness allowance Rs. 12,000 p.m.: Rs. 12,000 x 12 = Rs. 1,44,000

iii) He contributes 20% of his salary and D.A. to a Recognized Provident Fund.

Ans: He contributes 20% of his salary and D.A. to a Recognized Provident Fund: Rs. (4,80,000 + 1,44,000) x 20% = Rs. 1,24,800

iv) Employer’s contribution to provident fund is 14% of salary and Dearness Allowances.

Ans: Employer’s contribution to provident fund is 14% of salary and Dearness Allowances: (Rs. 4,80,000 + Rs. 1,44,000) x 14% = Rs. 1,26,560

v) Rent from house property Rs. 12,000 p.m.

Ans: Rent from house property Rs. 12,000 p.m.: Rs. 12,000 x 12 = Rs. 1,44,000

vi) Interest from an Indian company, Rs. 37,200 (Gross)

Ans: Interest from an Indian company, Rs. 37,200 (Gross): The interest income is taxable under the head “Income from Other Sources”. The taxable interest income will be Gross interest income – any deduction available under Section 80TTA. Assuming there are no other deductions, the taxable interest income will be Rs. 37,200.

vii) Life Insurance premium paid Rs. 4,000.

Ans: Life Insurance premium paid Rs. 4,000: The life insurance premium paid can be claimed as a deduction under Section 80C of the Income Tax Act up to a maximum limit of Rs. 1,50,000.

Total Income = Salary + Dearness Allowance + Employer’s contribution to Provident Fund + Rent from House Property + Interest from Indian Company = Rs. 4,80,000 + Rs. 1,44,000 + Rs. 1,26,560 + Rs. 1,44,000 + Rs. 37,200 = Rs. 9,32,760

Tax Payable: The tax liability will depend on the total income and the applicable tax slab rates for the assessment year 2022-23. Assuming that the individual is below 60 years of age and has no other deductions, the tax payable would be as follows:

- Up to Rs. 2,50,000: Nil

- Rs. 2,50,001 to Rs. 5,00,000: 5% of (Total income – Rs. 2,50,000)

- Rs. 5,00,001 to Rs. 10,00,000: Rs. 12,500 + 20% of (Total income – Rs. 5,00,000)

- Above Rs. 10,00,000: Rs. 1,12,500 + 30% of (Total income – Rs. 10,00,000)

Using these rates, the tax payable for the given income would be Rs. 75,352.

(b) Discuss the provisions of Income Tax Act dealing with the exemption of income of political parties.

Ans: Political parties are registered under the Representation of the People Act, 1951 and are considered as non-profit organizations. As per the provisions of the Income Tax Act, political parties are exempted from paying income tax on the income generated from the sources mentioned below:

- Contribution received from individuals/companies: Political parties receive donations/contributions from individuals and companies. As per Section 13A of the Income Tax Act, contributions received by a political party are exempt from income tax.

- Interest on securities: Interest received by a political party on securities held by it is also exempt from income tax.

- Income from house property: If a political party earns any income from renting out its property, it is also exempt from income tax.

However, it is important to note that these exemptions are available only if the political party complies with certain conditions. These conditions are as follows:

- The political party should be registered under Section 29A of the Representation of the People Act, 1951.

- The political party should maintain books of accounts and should get them audited by a Chartered Accountant.

- The political party should file its Income Tax Return on time.

- The political party should not accept any donation exceeding Rs. 2,000 from any person other than an Indian citizen who is ordinarily resident in India.

- The political party should maintain a record of contributions received in excess of Rs. 20,000 and should furnish the same to the Income Tax Department.

- The political party should not accept any contribution in cash exceeding Rs. 2,000.

- The political party should not engage in any commercial activity.

If a political party fails to comply with any of these conditions, it may lose its exemption from income tax. In such a case, the Income Tax Department may impose a penalty or disallow the exemption.

Write short notes on the following:

(a) Assessment Year

Ans: Assessment Year (AY) is the year following the financial year in which income is earned by an individual or a business. It is the year in which the income tax return for the previous financial year is assessed by the Income Tax Department. For example, if the financial year is 2021-22, the corresponding assessment year would be 2022-23.

During the assessment year, the Income Tax Department scrutinizes the income tax return filed by the taxpayer and verifies the income, deductions, and taxes paid. The department may also issue a notice to the taxpayer seeking clarification or additional information.

The assessment year is important as it is the year in which the taxpayer’s income tax liability is calculated and assessed. The taxpayer must file their income tax return for the relevant financial year by the due date to avoid penalties and interest charges.

(b) Cost of Improvement

Ans: Cost of improvement refers to the expenses incurred by a property owner for enhancing the value of a property or asset. It is the amount spent by the owner to make modifications or improvements to the property, such as renovation, repair, or reconstruction.

In the context of taxation, cost of improvement is a crucial factor in determining the capital gains tax liability of a property seller. Capital gains tax is the tax levied on the profit earned from the sale of a capital asset, such as a property, land, or shares. The capital gains tax is calculated by deducting the cost of acquisition of the asset from the sale price of the asset.

However, to arrive at the actual capital gains tax liability, the cost of improvement is also considered. The cost of improvement is added to the cost of acquisition of the asset to arrive at the indexed cost of acquisition. The indexed cost of acquisition is used to calculate the capital gains tax, which reduces the tax liability of the seller.

Thus, maintaining accurate records of the cost of improvement is essential for taxpayers to minimize their capital gains tax liability. The taxpayer must retain all receipts, invoices, and bills related to the expenses incurred for the improvement of the property to claim deductions during the sale of the asset.

(c) Perquisites

Ans: Perquisites, often referred to as “perks,” are benefits or advantages that employees receive in addition to their regular salary or wages. These perks are provided by employers to retain and motivate employees and can include a wide range of benefits, such as company cars, housing, interest-free loans, club memberships, medical insurance, etc.

Perquisites can be classified into two categories: taxable and non-taxable. Taxable perquisites are subject to tax and are included in an employee’s taxable income, while non-taxable perquisites are not subject to tax.

In India, perquisites are governed by the Income Tax Act, and their valuation and taxability depend on various factors, such as the type of perk, its value, and the employee’s salary.

The valuation of perquisites is usually done based on the cost to the employer, the market value, or a prescribed percentage of the employee’s salary. The tax liability on perquisites is usually borne by the employer, who deducts the tax from the employee’s salary or pays it on their behalf.

It is important for both employers and employees to understand the tax implications of perquisites to avoid any legal or financial issues. Employers should ensure that they comply with the regulations governing perquisites, and employees should disclose all the perquisites they receive to avoid any tax evasion charges.

(d) Income of Minor Child

Ans: The income of a minor child is taxable in India and is governed by the Income Tax Act. The Act defines a minor as an individual who has not attained the age of 18 years.

According to the Act, any income earned by a minor child is treated as the income of the parent whose total income is higher. The parent is liable to pay tax on the minor child’s income at the applicable tax rates.

However, there are some exemptions for certain types of income earned by minor children. For example, any income earned by a minor child from a club or a similar institution, up to Rs. 1,500, is exempt from tax. Additionally, any income earned by a minor child from activities such as acting, modeling, or sports, is exempt from tax up to Rs. 15,000.

If the minor child earns income from investments, such as fixed deposits or mutual funds, the interest or capital gains earned will be taxed as per the applicable tax rates. In such cases, the parent is required to file a separate income tax return for the minor child and disclose the minor’s income.

How to Download ECO-11 Solved Assignment?

You can download it from the www.edukar.in, they have a big database for all the IGNOU solved assignments.

Is the ECO-11 Solved Assignment Free?

Yes this is absolutely free to download the solved assignment from www.edukar.in

What is the last submission date for ECO-11 Solved Assignment?

For June Examination: 31st April, For December Examination: 30th October