| Title | ECO-10: IGNOU B.Com Solved Assignment 2022-2023 |

| University | IGNOU |

| Degree | Bachelor Degree Programme |

| Course Code | ECO-10 |

| Course Name | ELEMENTS OF COSTING |

| Programme Name | B.Com |

| Programme Code | BDP |

| Total Marks | 100 |

| Year | 2022-2023 |

| Language | English |

| Assignment Code | ECO-10/TMA/2022-23 |

| Assignment PDF | Click Here |

| Last Date for Submission of Assignment: | For June Examination: 31st April For December Examination: 30th September |

1. What is cost accounting? What are the major advantages of Cost Accounting to a manufacturing concern?

Ans: Cost accounting is a branch of accounting that deals with the recording, analysis, and reporting of costs incurred in the production of goods or services. It involves the identification of all the costs associated with producing a product or service, including direct costs such as materials and labor, as well as indirect costs such as rent, utilities, and depreciation.

The major advantages of cost accounting to a manufacturing concern are:

- Cost Control: Cost accounting helps manufacturers to identify the costs associated with each production process, enabling them to control and reduce costs where possible. By identifying and eliminating wasteful spending, manufacturers can increase their profits and remain competitive in the market.

- Pricing Decisions: Cost accounting provides manufacturers with accurate information on the costs associated with producing a product or service, which is crucial for making pricing decisions. Manufacturers can use this information to set prices that cover all the costs associated with production, including overhead costs, and still generate a profit.

- Performance Evaluation: Cost accounting enables manufacturers to evaluate their performance by comparing actual costs with planned costs. By identifying any variances, manufacturers can take corrective action to ensure that they are meeting their production goals and achieving their profit targets.

- Decision Making: Cost accounting provides manufacturers with the information they need to make informed decisions about the production process, such as whether to make or buy certain components, and whether to invest in new equipment or technology.

- Budgeting: Cost accounting provides manufacturers with the information they need to prepare budgets and forecast costs accurately. This helps manufacturers to manage their cash flow effectively and make informed decisions about future investments.

2. What do you mean by cost? What are the different methods of costing? Distinguish between direct cost and indirect cost.

Ans: Cost refers to the monetary value of the resources used to produce goods or services. In accounting, cost is defined as the expenditure incurred in the production of a product or service.

The different methods of costing include:

- Job Costing: This method is used when products or services are produced in distinct batches or jobs. The costs incurred in each job are tracked separately, making it easier to calculate the cost per unit.

- Process Costing: This method is used when products or services are produced in a continuous process, such as in the manufacturing of chemicals or food items. The costs incurred in each stage of the production process are tracked, and the total cost per unit is calculated by dividing the total cost by the total number of units produced.

- Activity–Based Costing: This method is used to assign costs to specific activities or processes that contribute to the production of a product or service. It involves identifying all the activities involved in the production process and assigning costs to each activity based on the resources consumed.

- Standard Costing: This method involves setting standard costs for each component of the production process and comparing actual costs against these standards. The difference between actual costs and standard costs is analyzed to identify areas for improvement.

Direct costs are costs that can be directly attributed to a specific product or service, such as the cost of materials, labor, and production overheads. Indirect costs, on the other hand, are costs that cannot be directly attributed to a specific product or service, such as rent, utilities, and administration expenses.

The main difference between direct costs and indirect costs is that direct costs are incurred specifically for the production of a product or service, while indirect costs are incurred to support the production process as a whole. Direct costs can be easily traced to a specific product or service, while indirect costs must be allocated based on a predetermined formula or cost driver.

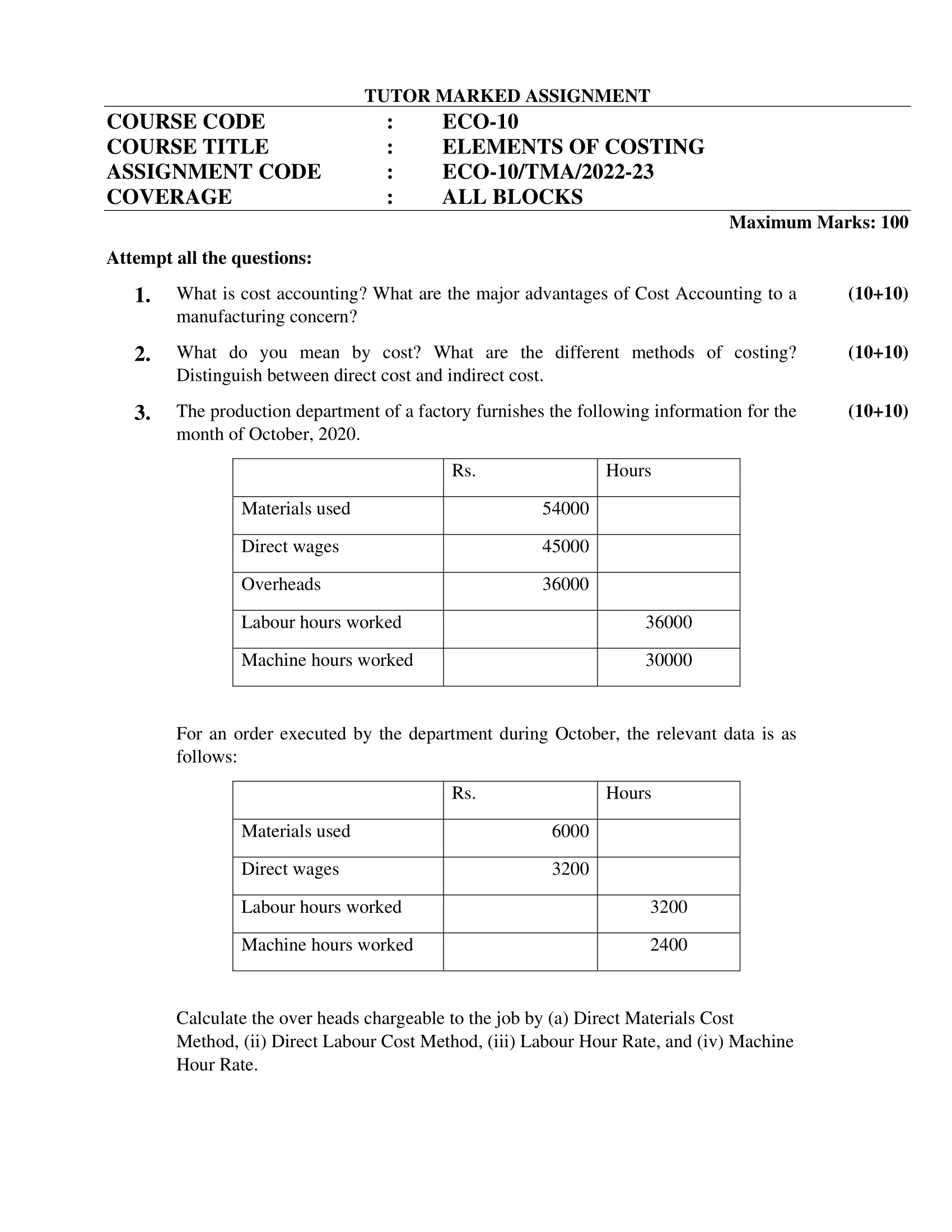

3. The production department of a factory furnishes the following information for the month of October, 2020.

| Rs | Hours | |

| Materials used | 54000 | |

| Direct wages | 45000 | |

| Overheads | 36000 | |

| Labour hours worked | 36000 | |

| Machine hours worked | 30000 |

For an order executed by the department during October, the relevant data is as follows:

| Rs | Hours | |

| Materials used | 6000 | |

| Direct wages | 3200 | |

| Labour hours worked | 3200 | |

| Machine hours worked | 2400 |

Calculate the over heads chargeable to the job by (a) Direct Materials Cost Method, (ii) Direct Labour Cost Method, (iii) Labour Hour Rate, and (iv) Machine Hour Rate.

Ans: (a) Direct Materials Cost Method:

=Overheads/Direct Material used x 100

=36,000/54,000 x 100

=66.67%

Overheads chargeable to order

=66.67% of Rs. 6,000

=Rs. 4,000

(b) Direct Labour Cost Method:

=Overheads/Direct wages x 100

=36,000/45,000 x 100

=80%

Overheads chargeable to order

=80% of Rs.3,200

=Rs. 2,560

(c) Labour Hour Rate: Overheads are allocated to the job based on the number of labor hours worked on the job.

Labour hour rate = Total overheads / Total labor hours worked = 36,000 / 36,000 = Rs. 1 per labor hour

Overheads chargeable to the job = Labour hours worked on the job x Labour hour rate = 3,200 x Rs. 1 = Rs. 3,200

(d) Machine Hour Rate: Overheads are allocated to the job based on the number of machine hours worked on the job.

Machine hour rate = Total overheads / Total machine hours worked = 36,000 / 30,000 = Rs. 1.2 per machine hour

Overheads chargeable to the job = Machine hours worked on the job x Machine hour rate = 2,400 x Rs. 1.2 = Rs. 2,880

Therefore, the overheads chargeable to the job by (a) Direct Materials Cost Method is Rs. 4,000, (b) Direct Labour Cost Method is Rs. 2,560, (c) Labour Hour Rate is Rs. 3,200, and (d) Machine Hour Rate is Rs. 2,880.

4. What do you understand by materials control? What are the important requirements of an efficient system of material control?

Ans: Materials control is the process of managing the flow of materials used in the production process, from the point of purchase to the point of use. The main objective of materials control is to ensure that the right materials are available at the right time, in the right quantity, and at the right cost, to minimize waste and maximize efficiency.

The important requirements of an efficient system of material control include:

- Accurate Forecasting: An efficient system of material control requires accurate forecasting of demand for materials. This involves analyzing historical sales data, market trends, and customer preferences to determine the likely demand for each material.

- Effective Purchasing: An efficient system of material control requires effective purchasing practices to ensure that materials are acquired at the lowest possible cost without compromising quality. This involves identifying reliable suppliers, negotiating favorable terms, and monitoring supplier performance.

- Inventory Management: An efficient system of material control requires effective inventory management practices to ensure that the right quantity of materials is available at the right time. This involves setting appropriate inventory levels, monitoring inventory levels, and reordering materials when necessary.

- Material Handling: An efficient system of material control requires effective material handling practices to ensure that materials are stored, transported, and handled properly to prevent damage and waste.

- Quality Control: An efficient system of material control requires effective quality control practices to ensure that materials meet the required quality standards. This involves inspecting materials upon receipt, monitoring quality during storage, and testing materials before use.

- Cost Control: An efficient system of material control requires effective cost control practices to ensure that the cost of materials is minimized without compromising quality or availability. This involves monitoring costs, identifying cost-saving opportunities, and implementing cost-saving measures where possible.

Write short notes on the following:

(a) Methods of absorption

Ans: Methods of absorption refer to the ways in which substances can be absorbed by another material. Here are some commonly used methods of absorption:

- Physical absorption: This method involves the adsorption of molecules onto the surface of another material, such as activated carbon, without any chemical reaction taking place. This method is commonly used to remove impurities from air or water.

- Chemical absorption: This method involves a chemical reaction between the substance to be absorbed and the material used for absorption. The most common example is the use of alkaline substances, such as sodium hydroxide or ammonia, to remove acidic gases, such as carbon dioxide or sulfur dioxide.

- Biological absorption: This method involves the use of living organisms, such as plants or bacteria, to absorb or break down pollutants. This method is commonly used in wastewater treatment.

- Ion exchange: This method involves the exchange of ions between the substance to be absorbed and the material used for absorption, such as resin beads. This method is commonly used for water softening.

- Membrane filtration: This method involves the use of a membrane with small pores to separate substances based on their size or charge. This method is commonly used in desalination or wastewater treatment.

(b) Rowan premium plan

Ans: Rowan system or Rowan plan:

The Rowan System, also known as the Rowan Plan or the Rowan Scheme, is a method of measuring worker efficiency and determining wages in industries that use standardized production methods. It is a type of piece-rate system that rewards workers based on their individual performance and productivity.

The Rowan Plan was developed by Walter J. Rowan in the early 1900s while he was working as an engineer for the Pennsylvania Railroad. The system is based on the concept of a standard time for completing a particular task, which is calculated by time-and-motion study or predetermined time standards. The standard time includes the time required to perform the work and a certain amount of time for rest and personal needs.

Under the Rowan System, workers are paid according to the number of units they produce in a given period of time, with the payment rate based on the standard time for each unit. If a worker completes their work in less than the standard time, they receive a bonus in addition to their regular pay. For example, if a worker produces 10 units in a day and the standard time for producing each unit is 30 minutes, the worker’s pay would be based on 5 hours of work (10 units x 30 minutes) plus any bonus earned for completing the work in less than the standard time.

The Rowan Plan has been widely used in manufacturing and other industries where work can be standardized and easily measured. Its advantages include providing an incentive for workers to increase their productivity, promoting efficiency and reducing waste, and enabling employers to accurately calculate labor costs. However, it has also been criticized for not taking into account factors such as teamwork, worker safety, and quality control, and for encouraging workers to sacrifice quality for speed.

(c) Overheads

Ans: Overheads refer to the indirect costs incurred by a business or organization that are not directly attributable to the production or sale of a specific product or service. These costs are necessary to keep the business or organization running, but they are not directly related to the goods or services being produced.

Examples of overhead costs include rent or mortgage payments on a facility, utilities such as electricity and water, office supplies, salaries of administrative or support staff, insurance, and taxes. Overheads are typically ongoing expenses that are incurred regardless of the level of production or sales.

In accounting, overhead costs are often allocated to the products or services being produced using various methods such as activity-based costing, direct labor hours, or machine hours. This helps to determine the true cost of producing a product or service and can be used to make informed pricing and production decisions. Managing overhead costs is an important aspect of financial management and can impact the profitability and sustainability of a business or organization.

(d) Control Accounts

Ans: Control accounts are a type of account used in accounting to keep track of and summarize the transactions and balances of subsidiary ledger accounts. A subsidiary ledger is a group of accounts that provide detailed information about individual transactions, such as accounts receivable or accounts payable, but it can be difficult to manage a large number of these accounts on an ongoing basis.

Control accounts are used to simplify the management of subsidiary ledger accounts by summarizing the information in a single account. For example, the accounts receivable control account summarizes the balances of all the individual customer accounts in the accounts receivable subsidiary ledger. The accounts payable control account summarizes the balances of all the individual vendor accounts in the accounts payable subsidiary ledger.

The use of control accounts allows for easier and more efficient management of subsidiary ledgers. It allows for easy identification and resolution of discrepancies between subsidiary ledger accounts and the corresponding control account. Control accounts also facilitate the preparation of financial statements by providing summary information that can be used in the financial reporting process.

Control accounts are typically reconciled on a regular basis to ensure that the balances in the control account and the subsidiary ledger accounts are accurate and in agreement. This helps to identify any errors or discrepancies in a timely manner, which can be corrected before they impact the accuracy of financial statements.

How to Download ECO-10 Solved Assignment?

You can download it from the www.edukar.in, they have a big database for all the IGNOU solved assignments.

Is the ECO-10 Solved Assignment Free?

Yes this is absolutely free to download the solved assignment from www.edukar.in

What is the last submission date for ECO-10 Solved Assignment?

For June Examination: 31st April, For December Examination: 30th October