| Title | ECO-14: IGNOU B.Com Solved Assignment 2022-2023 |

| University | IGNOU |

| Degree | Bachelor Degree Programme |

| Course Code | ECO-14 |

| Course Name | ACCOUNTANCY-II |

| Programme Name | B.Com |

| Programme Code | BDP |

| Total Marks | 100 |

| Year | 2022-2023 |

| Language | English |

| Assignment Code | ECO-14/TMA/2022-23 |

| Assignment PDF | Click Here |

| Last Date for Submission of Assignment: | For June Examination: 31st April For December Examination: 30th September |

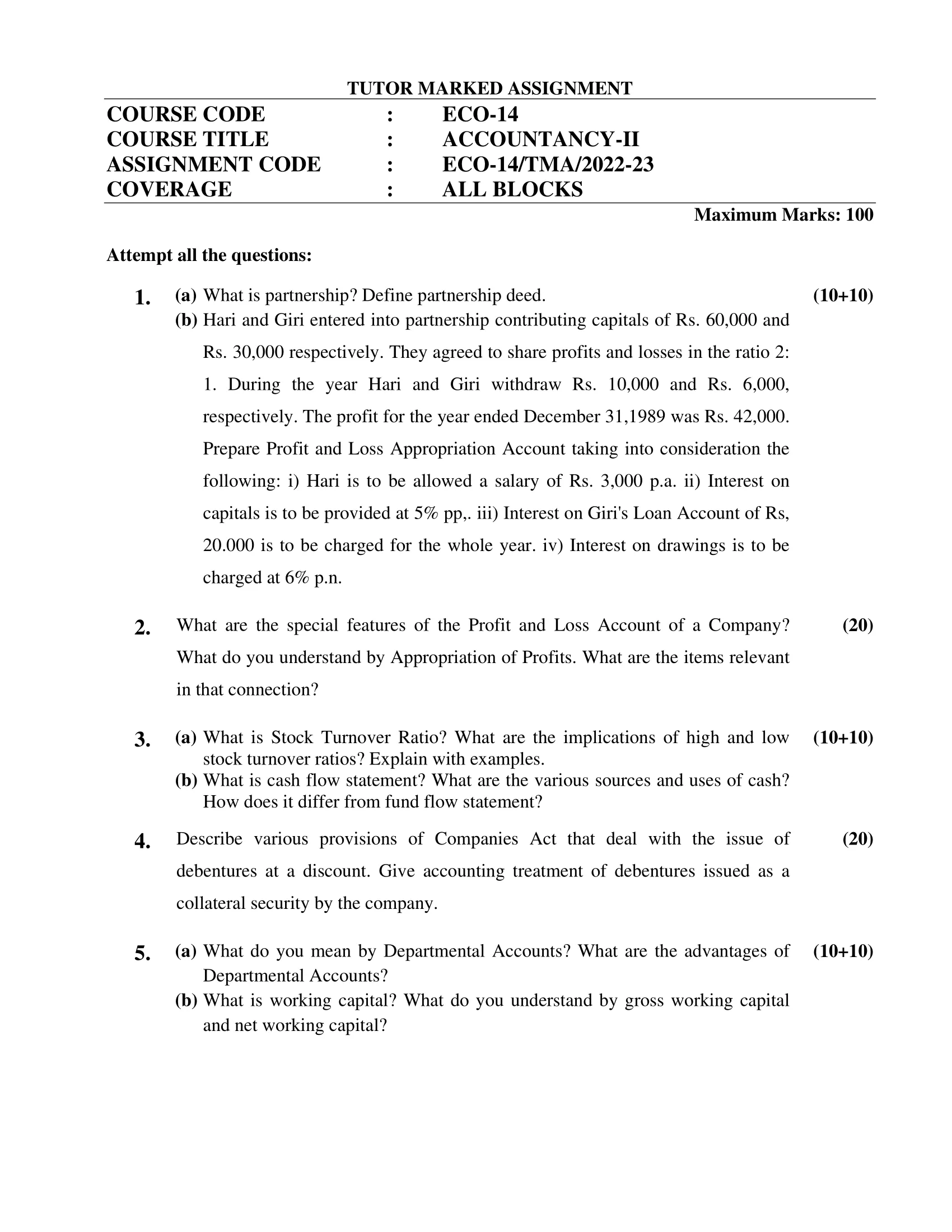

1. (a) What is partnership? Define partnership deed.

Ans: Partnership is a form of business organization where two or more individuals or entities come together to carry on a business with a view to making a profit. Each partner contributes resources, such as capital, labor, or expertise, and shares in the profits and losses of the business.

A partnership deed is a legal document that outlines the terms and conditions of the partnership between the partners. It specifies the rights and responsibilities of each partner, the nature of the business, the duration of the partnership, the capital contribution of each partner, the sharing of profits and losses, and the procedure for admission or retirement of partners.

The partnership deed also outlines the rules for the management of the business, the decision-making process, and the sharing of responsibilities among the partners. It serves as a contract between the partners and provides clarity and transparency in the partnership. The partnership deed is a crucial document that helps to prevent misunderstandings and disputes among partners.

(b) Hari and Giri entered into partnership contributing capitals of Rs. 60,000 and Rs. 30,000 respectively. They agreed to share profits and losses in the ratio 2:1. During the year Hari and Giri withdraw Rs. 10,000 and Rs. 6,000, respectively. The profit for the year ended December 31,1989 was Rs. 42,000. Prepare Profit and Loss Appropriation Account taking into consideration the following: i) Hari is to be allowed a salary of Rs. 3,000 p.a. ii) Interest on capitals is to be provided at 5% pp,. iii) Interest on Giri’s Loan Account of Rs, 20.000 is to be charged for the whole year. iv) Interest on drawings is to be charged at 6% p.n.

Ans: Profit and Loss Appropriation A/c

For the year ended on Dec 31,1989

| Particulars | Amount (Rs.) |

|---|---|

| Profit as per Profit and Loss Account | 42,000 |

| Add: Interest on capitals | 4,500 |

| Less: Salary to Hari | (3,000) |

| Less: Interest on Giri’s Loan Account | (1,000) |

| Net profit available for appropriation | 42,500 |

| Less: Interest on drawings | (960) |

| Balance carried down to Profit and Loss Appropriation Account | 41,280 |

| Total | 41,280 |

2. What are the special features of the Profit and Loss Account of a Company? What do you understand by Appropriation of Profits. What are the items relevant in that connection?

Ans: The Profit and Loss Account of a company is a financial statement that shows the revenues, expenses, gains, and losses of the company over a particular period of time, usually one year. The special features of the Profit and Loss Account of a company include:

- Revenue and expense recognition: The Profit and Loss Account recognizes all revenues and expenses incurred by the company during the accounting period.

- Accrual basis of accounting: The Profit and Loss Account is prepared on an accrual basis, which means that revenues and expenses are recognized when they are earned or incurred, regardless of when the cash is received or paid.

- Matching principle: The Profit and Loss Account follows the matching principle, which requires that expenses be matched to the revenues they generate in order to calculate the net profit or loss of the company.

- Comprehensive income: The Profit and Loss Account may include items that are not part of the traditional income statement, such as gains and losses on investments, foreign exchange gains or losses, and other comprehensive income.

Appropriation of profits refers to the allocation of the profits earned by a company after deducting all expenses, taxes, and dividends. This allocation is made among various items such as reserves, dividends, bonus shares, etc. The items relevant in the appropriation of profits include:

- Dividends: The Profit and Loss Account may include a provision for dividends to be paid to the shareholders.

- Reserves: The company may set aside a portion of its profits as reserves, which can be used to finance future growth or as a cushion against unexpected losses.

- Bonus shares: The company may issue bonus shares to its shareholders as a way of sharing its profits.

- Taxation: The company must pay taxes on its profits, which are deducted from the net profit before any appropriation is made.

- Retained earnings: The remaining profits are retained by the company and can be used for various purposes such as financing expansion or repaying debt.

3. (a) What is Stock Turnover Ratio? What are the implications of high and low stock turnover ratios? Explain with examples.

Ans: The stock turnover ratio, also known as inventory turnover ratio, is a financial metric that measures how quickly a company is selling and replacing its inventory. It is calculated by dividing the cost of goods sold by the average inventory during a particular period of time.

Formula: Stock turnover ratio = Cost of goods sold / Average inventory

A high stock turnover ratio indicates that a company is selling its inventory quickly, which is generally seen as a positive sign. It implies that the company is efficient in managing its inventory, has a strong demand for its products, and is generating revenue quickly. A low stock turnover ratio, on the other hand, suggests that a company is not selling its inventory quickly enough, which can be a sign of overstocking or slow sales.

Implications of high and low stock turnover ratios:

- High stock turnover ratio: A high stock turnover ratio generally indicates that a company is managing its inventory effectively and is generating revenue quickly. However, it can also mean that a company is not stocking enough inventory, which can result in lost sales opportunities. For example, a grocery store with a high stock turnover ratio may sell perishable goods quickly, but may run out of stock frequently, leading to lost sales.

- Low stock turnover ratio: A low stock turnover ratio indicates that a company is not selling its inventory quickly enough, which can be a sign of overstocking or slow sales. It can result in increased holding costs, such as storage and insurance costs, and can tie up valuable capital in unsold inventory. For example, a car dealership with a low stock turnover ratio may have too many cars in stock, leading to higher holding costs and tying up capital that could be used for other business purposes.

(b) What is cash flow statement? What are the various sources and uses of cash? How does it differ from fund flow statement?

Ans: A cash flow statement is a financial statement that shows the inflows and outflows of cash in a business over a specific period of time. It records the cash transactions of a company, including cash receipts from sales, cash payments for expenses, and cash inflows and outflows from investing and financing activities.

The various sources and uses of cash that are reported in a cash flow statement include:

Sources of cash:

- Cash sales

- Collections from customers

- Proceeds from the sale of assets

- Interest and dividend income

- Proceeds from the issuance of debt or equity

Uses of cash:

- Payment to suppliers for goods and services

- Payment of salaries and wages

- Purchase of inventory or assets

- Payment of interest and taxes

- Payment of dividends to shareholders

- Repayment of debt

The cash flow statement differs from the fund flow statement in several ways:

- Scope: The cash flow statement shows only cash transactions, whereas the fund flow statement shows both cash and non-cash transactions.

- Focus: The cash flow statement focuses on the inflows and outflows of cash during a specific period, while the fund flow statement focuses on the changes in the working capital of the company.

- Timeframe: The cash flow statement covers a shorter period of time, usually a month, quarter or year, while the fund flow statement covers a longer period of time, usually a year.

- Purpose: The cash flow statement is prepared to provide information on the liquidity position of the company, whereas the fund flow statement is prepared to provide information on the changes in the financial position of the company.

4. Describe various provisions of Companies Act that deal with the issue of debentures at a discount. Give accounting treatment of debentures issued as a collateral security by the company.

Ans: The Companies Act, 2013 lays down provisions regarding the issue of debentures at a discount. The following are the provisions:

- Section 52(2) of the Companies Act, 2013: This section permits a company to issue debentures at a discount, provided the following conditions are met:

a. The issue of debentures at a discount must be authorized by the company’s articles of association.

b. The issue of debentures must be approved by a special resolution passed by the shareholders.

c. The company must provide adequate security for the debentures issued.

- Section 71 of the Companies Act, 2013: This section provides that a company may issue secured debentures, which are backed by a charge on the company’s assets. The charge created on the assets should be registered with the Registrar of Companies within 30 days of its creation.

Accounting treatment of debentures issued as collateral security by the company:

When a company issues debentures as collateral security, it means that the debentures are backed by a charge on the company’s assets. The accounting treatment for such debentures is as follows:

- When the debentures are issued:

a. The face value of the debentures is credited to the “Debentures Account” in the balance sheet.

b. The value of the assets pledged as collateral security is debited to the “Fixed Assets Account.”

- When interest is paid on the debentures:

a. The interest paid on the debentures is debited to the “Interest on Debentures Account.”

b. The “Interest on Debentures Account” is then credited to the “Debentures Account.”

- When the debentures are redeemed:

a. The face value of the debentures is debited to the “Debentures Account.”

b. The value of the assets pledged as collateral security is credited to the “Fixed Assets Account.”

5. (a) What do you mean by Departmental Accounts? What are the advantages of Departmental Accounts?

Ans: Departmental accounts refer to the accounting method that separates the accounts of a business according to its functional departments or units, such as sales, production, administration, and marketing. In this method, each department’s expenses, revenues, and profits are recorded and reported separately.

The advantages of departmental accounts include:

- Performance measurement: Departmental accounts provide a better insight into the performance of each department by analyzing their financial statements separately. This allows managers to make more informed decisions about resource allocation and performance improvement strategies.

- Cost control: Departmental accounts help identify the costs associated with each department, which can be analyzed to identify areas where costs can be reduced or eliminated.

- Budgeting: Departmental accounts can be used to create budgets for each department, enabling managers to monitor the department’s performance against budgeted figures.

- Motivation: Departmental accounts provide a sense of ownership to each department by assigning financial responsibility to them. This can motivate department heads and employees to work more efficiently and effectively.

- Reporting: Departmental accounts allow for more detailed and accurate financial reporting, which is essential for stakeholders such as shareholders, creditors, and investors.

(b) What is working capital? What do you understand by gross working capital and net working capital?

Ans: Working capital refers to the amount of money a company has available to cover its day-to-day operating expenses and short-term obligations. It represents the difference between current assets and current liabilities and is a key indicator of a company’s financial health and liquidity.

Gross working capital refers to the total amount of current assets a company has on hand, including cash, accounts receivable, inventory, and other short-term assets. Gross working capital does not take into account any short-term liabilities, such as accounts payable or short-term loans.

Net working capital, on the other hand, refers to the difference between a company’s current assets and its current liabilities. It represents the amount of funds a company has available to cover its short-term obligations after subtracting any liabilities. Positive net working capital indicates that a company has enough funds to cover its short-term obligations, while negative net working capital indicates that a company may have difficulty meeting its short-term obligations.

Net working capital is a more accurate measure of a company’s liquidity than gross working capital because it takes into account the company’s short-term liabilities. A company with high gross working capital but also high short-term liabilities may have a low net working capital, indicating that it may have difficulty meeting its short-term obligations.

How to Download ECO-14 Solved Assignment?

You can download it from the www.edukar.in, they have a big database for all the IGNOU solved assignments.

Is the ECO-14 Solved Assignment Free?

Yes this is absolutely free to download the solved assignment from www.edukar.in

What is the last submission date for ECO-14 Solved Assignment?

For June Examination: 31st April, For December Examination: 30th October