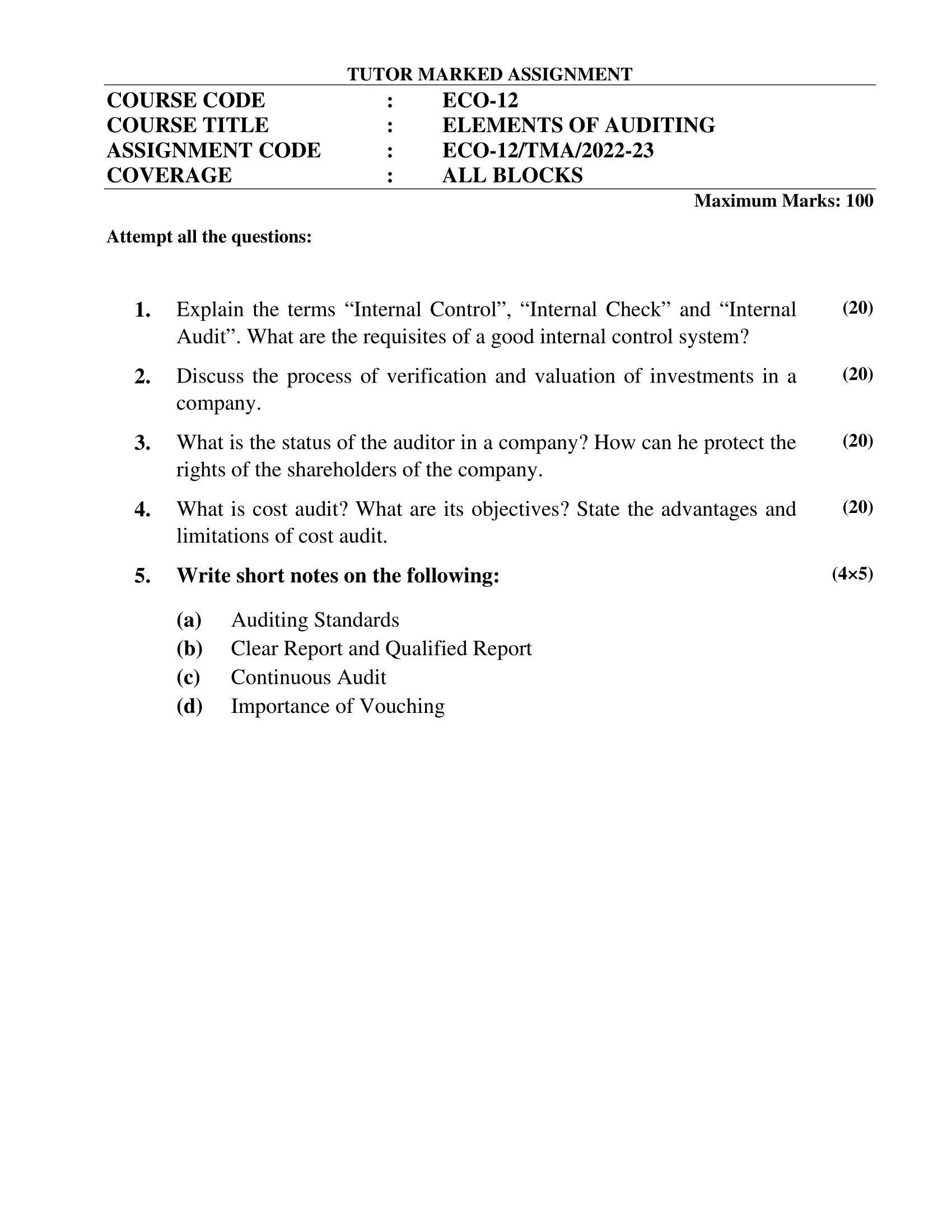

| Title | ECO-12: IGNOU B.Com Solved Assignment 2022-2023 |

| University | IGNOU |

| Degree | Bachelor Degree Programme |

| Course Code | ECO-12 |

| Course Name | ELEMENTS OF AUDITING |

| Programme Name | B.Com |

| Programme Code | BDP |

| Total Marks | 100 |

| Year | 2022-2023 |

| Language | English |

| Assignment Code | ECO-12/TMA/2022-23 |

| Assignment PDF | Click Here |

| Last Date for Submission of Assignment: | For June Examination: 31st April For December Examination: 30th September |

1. Explain the terms “Internal Control”, “Internal Check” and “Internal Audit”. What are the requisites of a good internal control system?

Ans: Internal Control: Internal control refers to the set of policies, procedures, and practices that an organization implements to ensure the achievement of its objectives in an efficient and effective manner. It encompasses all the measures that an organization takes to safeguard its assets, prevent and detect fraud or errors, ensure compliance with laws and regulations, and promote the reliability and accuracy of financial reporting.

Internal Check: Internal check refers to the systematic review and verification of the accounting records and financial transactions of an organization by its own staff. The purpose of internal check is to ensure that the accounting records are accurate and complete, and that the financial transactions are properly authorized and recorded in the books of accounts. Internal check is an ongoing process and is usually carried out by different staff members at different stages of the accounting cycle.

Internal Audit: Internal audit refers to the independent and objective examination of an organization’s financial, operational, and compliance processes by its own internal auditors. The purpose of internal audit is to provide assurance to the management that the organization’s internal control system is operating effectively, and to identify opportunities for improvement. Internal auditors are appointed by the management and report to the Audit Committee of the Board of Directors.

Requisites of a Good Internal Control System:

- Well-defined policies and procedures: The organization must have clearly defined policies and procedures that are communicated to all employees and stakeholders.

- Separation of duties: The duties and responsibilities of different staff members must be segregated to prevent fraud and errors.

- Proper authorization: All financial transactions must be properly authorized by authorized personnel.

- Adequate records and documentation: The organization must maintain adequate records and documentation to support its financial transactions.

- Physical control over assets: The organization must have physical control over its assets to prevent loss or theft.

- Periodic reviews and reconciliations: The organization must periodically review and reconcile its financial records to ensure their accuracy and completeness.

- Regular reporting: The organization must regularly report its financial performance and compliance with laws and regulations to its stakeholders.

- Continuous monitoring: The organization must continuously monitor its internal control system and make necessary improvements to ensure its effectiveness.

2. Discuss the process of verification and valuation of investments in a company.

Ans: Verification and valuation of investments are crucial steps in the preparation of financial statements for any company. Investments refer to any assets held by a company for the purpose of generating income or capital appreciation. These assets can include equity shares, bonds, mutual funds, and other securities. The process of verification and valuation of investments involves the following steps:

- Verification of Investments: The first step is to verify the existence of the investments. The company should confirm that the investments recorded in the books of accounts are actually held by the company. The verification process involves matching the investment certificates or statements with the company’s records. The company should also confirm that the investments are held in the name of the company and not in the name of any individual.

- Classification of Investments: The second step is to classify the investments based on the purpose of holding. The investments can be classified as either current or long-term investments. Current investments are those that are expected to be sold within a year, while long-term investments are those that are held for more than a year.

- Valuation of Investments: The next step is to determine the fair value of the investments. The fair value of the investments is the amount at which the investments could be sold in an arm’s length transaction. The fair value can be determined using various methods such as market value, net asset value, or discounted cash flow method. The method used for valuation depends on the nature of the investment.

- Disclosure in Financial Statements: The final step is to disclose the investments in the financial statements. The company should disclose the nature of the investments, their classification, and the fair value of the investments. The disclosure should also include any changes in the fair value of the investments and any gains or losses realized on the sale of the investments.

3. What is the status of the auditor in a company? How can he protect the rights of the shareholders of the company.

Ans: The auditor plays a critical role in ensuring the accuracy and reliability of a company’s financial statements. The auditor is an independent third party appointed by the shareholders of the company to provide an objective opinion on the financial statements prepared by the company’s management.

The auditor’s status in a company is that of an independent contractor who is appointed by the shareholders to provide an unbiased assessment of the financial statements. The auditor is not an employee of the company and is not subject to the control or direction of the company’s management.

To protect the rights of the shareholders of the company, the auditor must perform his duties in accordance with the auditing standards and principles. The auditor should ensure that the financial statements are prepared in accordance with the applicable accounting standards and that they present a true and fair view of the company’s financial position and performance.

The auditor can protect the rights of the shareholders by performing the following tasks:

- Conducting a thorough audit: The auditor should perform a comprehensive audit of the company’s financial statements, including a review of the accounting records and procedures, and testing of the financial transactions.

- Identifying and reporting any irregularities: If the auditor identifies any irregularities or fraudulent activities, he should report them to the shareholders of the company.

- Providing an independent opinion: The auditor should provide an unbiased and independent opinion on the financial statements, which can help the shareholders make informed decisions about the company.

- Ensuring compliance with laws and regulations: The auditor should ensure that the company is complying with the applicable laws and regulations, which can protect the shareholders from any legal or financial risks.

4. What is cost audit? What are its objectives? State the advantages and limitations of cost audit.

Ans: Cost audit is an independent examination of a company’s cost accounting records and cost statements, with the objective of verifying the accuracy of cost accounting and ensuring that costs are properly classified, allocated, and reported in the financial statements. Cost audit aims to provide a reasonable assurance that the company’s cost accounting system is effective, efficient, and compliant with relevant laws and regulations.

The main objectives of cost audit are:

- To verify the accuracy and reliability of the company’s cost accounting system.

- To ensure that the company’s costs are reasonable and properly allocated.

- To identify any inefficiencies or wastage in the company’s operations.

- To provide feedback to management on how to improve cost control and reduce costs.

- To ensure compliance with relevant laws and regulations.

Advantages of cost audit include:

- Improved cost control: Cost audit can identify inefficiencies and wastage in the company’s operations, which can lead to cost savings and improved cost control.

- Improved profitability: By identifying areas of cost inefficiency, cost audit can help increase the company’s profitability.

- Improved decision-making: Cost audit can provide management with accurate and reliable cost information, which can help them make informed decisions.

- Compliance with regulations: Cost audit can ensure that the company complies with relevant laws and regulations.

Limitations of cost audit include:

- Costly: Cost audit can be costly, particularly for small businesses.

- Time-consuming: Cost audit can be time-consuming, particularly if the company has a large and complex cost accounting system.

- Limited scope: Cost audit only focuses on the company’s cost accounting system and may not identify other areas of inefficiency in the company’s operations.

- Limited assurance: Cost audit provides only reasonable assurance that the company’s cost accounting system is effective, efficient, and compliant with relevant laws and regulations.

5. Write short notes on the following:

(a) Auditing Standards

Ans: Auditing standards are a set of guidelines and principles that are developed by professional organizations, such as the International Auditing and Assurance Standards Board (IAASB) and the American Institute of Certified Public Accountants (AICPA), to ensure that auditors perform their work in a consistent and high-quality manner. These standards provide a framework for auditors to plan and perform their work, assess the effectiveness of a company’s internal controls, and evaluate the accuracy and completeness of financial statements. Adherence to auditing standards is essential to maintain the integrity and objectivity of the audit process, as well as to promote public confidence in financial reporting.

(b) Clear Report and Qualified Report

Ans: Clear report and qualified report are two types of audit reports issued by auditors after they have completed an audit of a company’s financial statements.

A clear report is issued when the auditor has reviewed the financial statements and found them to be accurate, complete, and in compliance with accounting principles and regulations. This means that the financial statements present a true and fair view of the company’s financial position, performance, and cash flows. A clear report is considered a positive outcome for the company, and it indicates that there are no significant issues or concerns with the financial statements.

On the other hand, a qualified report is issued when the auditor has identified one or more material misstatements or limitations in the financial statements. This means that there is some uncertainty or lack of clarity regarding the company’s financial position, performance, or cash flows. A qualified report is considered a negative outcome for the company, as it suggests that there are significant issues or concerns with the financial statements. In a qualified report, the auditor will explain the nature and extent of the issue, as well as any potential implications for the company and its stakeholders.

(c) Continuous Audit

Ans: Continuous auditing is a method of auditing that involves the use of technology to perform audit procedures on a continuous basis. This approach involves the use of automated tools to continuously monitor financial transactions and other business processes, and to detect potential errors or irregularities in real-time.

Continuous auditing is an evolution of traditional auditing, which typically involves a periodic review of financial statements and other financial information. Continuous auditing provides auditors with the ability to detect issues in real-time, allowing them to identify and address potential problems before they become significant.

The benefits of continuous auditing include increased efficiency, greater accuracy, and improved risk management. By automating many of the auditing tasks, auditors can spend more time analyzing data and identifying potential risks, which can help to prevent fraud and other financial irregularities.

(d) Importance of Vouching

Ans: Vouching is an essential audit procedure that involves examining and verifying the authenticity, accuracy, and completeness of transactions by tracing them from their source documents to their entry in the financial records. The importance of vouching in the audit process can be summarized as follows:

- Detection of errors and fraud: Vouching helps to detect errors and fraud in the financial records by ensuring that all transactions are properly authorized, supported by appropriate documentation, and accurately recorded.

- Verification of completeness: Vouching helps to ensure that all transactions that should have been recorded in the financial records have been included, and that there are no omissions.

- Verification of accuracy: Vouching helps to ensure that transactions have been recorded accurately in the financial records, including the correct amounts, dates, and accounts.

- Verification of existence: Vouching helps to verify that the transactions actually took place and that the goods or services were received or delivered as recorded.

- Verification of ownership: Vouching helps to verify that the assets and liabilities recorded in the financial records are owned or owed by the entity being audited.

How to Download ECO-12 Solved Assignment?

You can download it from the www.edukar.in, they have a big database for all the IGNOU solved assignments.

Is the ECO-12 Solved Assignment Free?

Yes this is absolutely free to download the solved assignment from www.edukar.in

What is the last submission date for ECO-12 Solved Assignment?

For June Examination: 31st April, For December Examination: 30th October