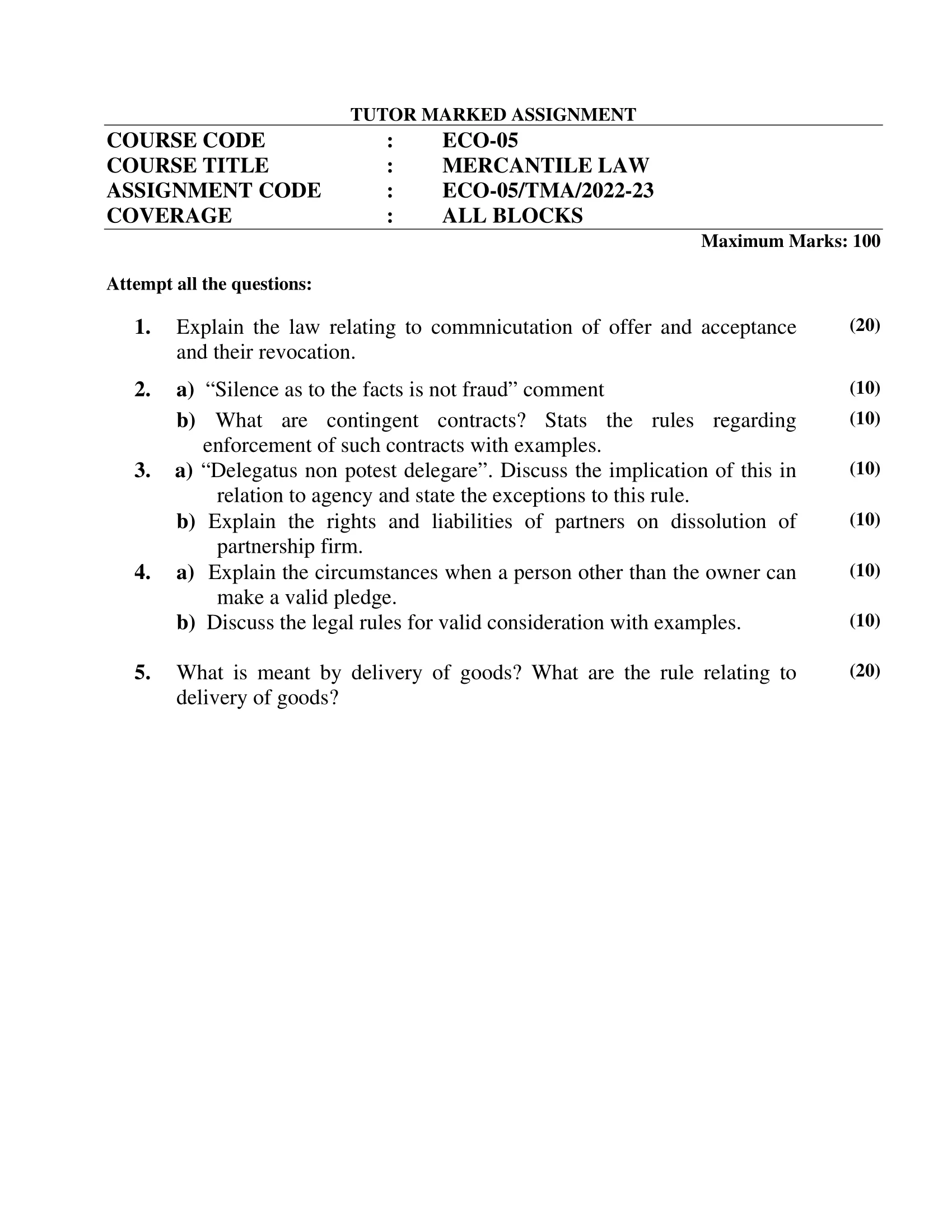

| Title | ECO-05: IGNOU B.Com Solved Assignment 2022-2023 |

| University | IGNOU |

| Degree | Bachelor Degree Programme |

| Course Code | ECO-05 |

| Course Name | MERCANTILE LAW |

| Programme Name | B.Com |

| Programme Code | BDP |

| Total Marks | 100 |

| Year | 2022-2023 |

| Language | English |

| Assignment Code | ECO-05/TMA/2022-23 |

| Assignment PDF | Click Here |

| Last Date for Submission of Assignment: | For June Examination: 31st April For December Examination: 30th September |

1. Explain the law relating to commnicutation of offer and acceptance and their revocation.

Ans: The law relating to communication of offer and acceptance and their revocation is an important aspect of contract law. In order for a contract to be formed, there must be an offer, acceptance of that offer, and consideration. Let’s break down each element:

- Offer: An offer is a proposal by one party to another indicating a willingness to enter into a contract. It must be clear, definite, and made with the intention of creating a binding agreement.

- Acceptance: Acceptance is the expression of agreement to the terms of an offer. It must be unconditional and in accordance with the terms of the offer.

- Consideration: Consideration is the exchange of something of value between the parties. It can be in the form of money, goods, or services.

Now, let’s discuss the law relating to communication of offer and acceptance and their revocation:

- Communication of offer: An offer must be communicated to the offeree (the person to whom the offer is made). The offer can be communicated in writing, orally, or through conduct. The offer is effective once it is received by the offeree, meaning that the offeree must have knowledge of the offer in order to accept it.

- Communication of acceptance: Acceptance must be communicated to the offeror (the person who made the offer). The acceptance must be communicated in the same manner as the offer, unless the offer specifies otherwise. If the offeror specifies a particular method of communication, acceptance must be communicated in that manner. An acceptance is effective once it is received by the offeror.

- Revocation of offer: An offer can be revoked (withdrawn) at any time before it is accepted, unless the offer is irrevocable. An offer can be made irrevocable through an option contract, detrimental reliance, or by statute. If an offer is revoked before acceptance, it is no longer available to be accepted.

- Revocation of acceptance: Acceptance can also be revoked, but only under limited circumstances. If the offeror has not yet relied on the acceptance or begun to perform under the contract, the offeree may revoke acceptance. However, once the offeror has relied on the acceptance or begun to perform, the acceptance is no longer revocable.

2. a)“Silence as to the facts is not fraud” comment

Ans: The statement “silence as to the facts is not fraud” means that a person cannot be accused of committing fraud by simply remaining silent about certain information, even if that information is important to the transaction. In other words, a person is under no legal obligation to disclose all relevant information about a transaction unless there is a legal duty to do so, such as in cases of a fiduciary relationship or in certain industries where disclosure is required by law.

For example, if you sell a used car to someone and you know that the car has a serious mechanical issue but you do not disclose it, you cannot be accused of fraud if the buyer discovers the issue after the sale. However, if you are a real estate agent and you know that the property you are selling has a serious structural issue, you may have a legal duty to disclose that information to the buyer, and failure to do so may constitute fraud.

It is important to note that while silence itself may not be fraud, actively concealing or misrepresenting information can be considered fraud. In other words, if someone intentionally hides or distorts the truth to deceive another person, they may be guilty of fraud, even if they do not say anything false.

b) What are contingent contracts? Stats the rules regarding enforcement of such contracts with examples.

Ans: Contingent contracts are contracts in which the performance of one or both parties is contingent upon the occurrence or non-occurrence of a particular event. In other words, a contingent contract is a contract in which the parties agree to do something only if a specific condition is met. The rules regarding enforcement of contingent contracts are as follows:

- The condition must be uncertain: The contingency must be an uncertain event. If the event is certain to happen or not happen, the contract is not contingent.

- The event must be collateral to the contract: The event upon which the contingency depends must be collateral to the contract, meaning it must not be the subject matter of the contract itself. For example, a contract to sell a house on the condition that the buyer gets a loan is a contingent contract because the contingency is collateral to the sale of the house.

- The contingency must not be within the control of either party: The contingency must be something that neither party can control. If the contingency is within the control of one of the parties, the contract is not contingent.

- The contract must be enforceable without the contingency: The contract must be enforceable even if the contingency does not occur. In other words, the contract must be able to stand on its own without the occurrence of the contingency.

Examples of contingent contracts include:

- An insurance policy: An insurance policy is a contingent contract because the insurer agrees to pay out only if a specific event, such as a fire or flood, occurs.

- A contract to sell a house on the condition that the buyer gets a loan: This is a contingent contract because the sale of the house is contingent upon the buyer obtaining a loan.

- A contract to pay a bonus if a certain sales target is reached: This is a contingent contract because the payment of the bonus is contingent upon the achievement of the sales target.

3. a) “Delegatus non potest delegare”. Discuss the implication of this in relation to agency and state the exceptions to this rule.

Ans: “Delegatus non potest delegare” is a Latin legal maxim that means “a delegate cannot delegate”. This principle states that a person who has been delegated authority or responsibility by another person cannot delegate that same authority or responsibility to a third party. In other words, if someone has been given a task or duty, they cannot simply pass it on to someone else without the express consent of the delegator.

Implications in relation to agency: The principle of “delegatus non potest delegare” has important implications in the context of agency relationships. An agent who has been appointed by a principal to act on their behalf cannot delegate their authority to a third party without the express consent of the principal. If the agent does delegate their authority without the principal’s consent, the principal may be able to terminate the agency relationship and sue the agent for breach of contract.

Exceptions to the rule: There are some exceptions to the principle of “delegatus non potest delegare”. These include:

- Customary delegation: In some industries or professions, it is customary for an agent to delegate certain tasks or duties to others. For example, a lawyer may delegate certain administrative tasks to a legal secretary.

- Implied delegation: In certain circumstances, an agent may be able to delegate their authority if it is implied from the context of the relationship. For example, if an employer hires an employee to manage a project, the employer may be deemed to have impliedly authorized the employee to delegate certain tasks to others.

- Necessity: In situations where it is necessary to delegate authority in order to achieve a particular goal, an agent may be able to delegate their authority. For example, a ship captain may need to delegate certain tasks to crew members in order to safely navigate the ship.

b) Explain the rights and liabilities of partners on dissolution of partnership firm.

Ans: When a partnership firm is dissolved, the rights and liabilities of the partners are determined by the terms of the partnership agreement, if any, and by the provisions of the relevant partnership law. In general, the following rights and liabilities apply to partners on dissolution of a partnership firm:

- Right to share in partnership assets: Upon dissolution, the partners are entitled to their share of the partnership assets after all debts and liabilities of the firm have been paid off. The share of each partner in the assets of the partnership is determined by the partnership agreement or by the relevant partnership law.

- Liability for partnership debts and obligations: Each partner is liable for the debts and obligations of the partnership, including those incurred before dissolution. If the partnership assets are insufficient to pay off all the debts and obligations of the firm, each partner is personally responsible for paying their share of the shortfall.

- Right to wind up the partnership affairs: After dissolution, the partners have the right to wind up the affairs of the partnership. This involves collecting the partnership assets, paying off the debts and liabilities of the firm, and distributing any remaining assets to the partners in accordance with their share in the partnership.

- Authority to bind the partnership: The authority of partners to bind the partnership ceases upon dissolution, except for the purpose of winding up the affairs of the partnership.

- Liability for wrongful dissolution: If a partner wrongfully dissolves the partnership, they may be held liable for any damages suffered by the other partners as a result of the dissolution.

- Right to compete with the partnership: After dissolution, partners are free to compete with the partnership, subject to any restrictions in the partnership agreement or relevant partnership law.

- Indemnification: Partners are entitled to be indemnified by the partnership for any liabilities they have incurred on behalf of the partnership.

4. a) Explain the circumstances when a person other than the owner can make a valid pledge.

Ans: A pledge is a type of security interest in which a person (the pledgor) gives possession of a property to another person (the pledgee) as collateral for a debt or obligation. The pledgee has the right to retain possession of the property until the debt is paid or the obligation is fulfilled. Generally, only the owner of the property can make a valid pledge. However, there are certain circumstances when a person other than the owner can make a valid pledge, including:

- Pledge by an agent: An agent who is authorized to act on behalf of the owner can make a valid pledge of the owner’s property. The agent must have the authority to pledge the property, and the pledge must be made in the course of the agent’s authorized activities.

Example: A property owner authorizes a real estate agent to sell their property. The real estate agent pledges the property as collateral for a loan to finance the sale of the property.

- Pledge by a bailee: A bailee is a person who holds the property of another for a specific purpose. If the bailee has possession of the property and is authorized to pledge it, the pledge will be valid.

Example: A jeweler holds a customer’s jewelry for repair. The jeweler pledges the jewelry as collateral for a loan to finance their business.

- Pledge by a seller: If a seller of goods retains possession of the goods after the sale and is authorized to pledge them, the pledge will be valid.

Example: A car dealer sells a car to a customer on credit. The dealer retains possession of the car until the customer pays the full amount. The dealer pledges the car as collateral for a loan to finance their business.

- Pledge by a person with apparent authority: If a person has apparent authority to pledge the property, the pledge may be valid even if they do not have actual authority.

Example: An employee of a company who has possession of the company’s property pledges the property as collateral for a personal loan. The lender believes the employee has the authority to pledge the property, and the company does not object.

b) Discuss the legal rules for valid consideration with examples.

Ans: Consideration is an essential element of a valid contract. It refers to something of value that is given by one party to the other in exchange for a promise or performance. Consideration can take various forms, including money, goods, services, promises, or even abstaining from doing something.

To be valid, consideration must meet the following legal rules:

- It must be given at the request of the promisor: Consideration must be given in exchange for a promise or performance that has been requested by the promisor. Consideration given voluntarily or without a request cannot form the basis of a contract.

Example: If A promises to pay B $100 in exchange for mowing A’s lawn, B’s act of mowing the lawn at A’s request is valid consideration.

- It must be of some value: Consideration must have some value, whether it is monetary or non-monetary. The value of consideration is determined by the parties to the contract, and it need not be equal to the value of the promise or performance.

Example: If A promises to give B a book, and B promises to give A a pen in exchange, both the book and the pen have value, and therefore, it is valid consideration.

- It must be legal: Consideration must be lawful and not against public policy. If the consideration is illegal, immoral, or against public policy, the contract will be deemed void.

Example: If A promises to pay B $100 in exchange for B selling illegal drugs to A, the consideration is illegal, and the contract will be deemed void.

- It must not be past consideration: Consideration must be given before or at the time of the promise or performance. Consideration given before the promise or performance is known as executed consideration and is not valid. Similarly, consideration given after the promise or performance is known as past consideration and is also not valid.

Example: If A promises to pay B $100 for work that B has already completed, the consideration is past, and the contract will be deemed void.

- It must be real and not illusory: Consideration must be real and tangible and not based on a vague or illusory promise or performance.

Example: If A promises to pay B $100 if B feels like it, this is an illusory promise, and there is no valid consideration.

These are the legal rules for valid consideration. In summary, consideration must be given at the request of the promisor, have some value, be legal, not be past consideration, and be real and not illusory.

5. What is meant by delivery of goods? What are the rule relating to delivery of goods?

Ans: Delivery of goods refers to the transfer of possession of goods from one person (the seller) to another (the buyer) in accordance with the terms of a contract or agreement between them. Delivery of goods is an important aspect of any transaction involving the sale or transfer of goods as it determines when the buyer becomes responsible for the goods and when the seller’s obligations are fulfilled.

The rules relating to delivery of goods are governed by various laws and regulations, including the Sale of Goods Act, 1930. The rules vary depending on the type of goods, the terms of the contract, and the mode of delivery. However, some of the general rules relating to delivery of goods are:

- Time of delivery: The time of delivery is usually specified in the contract, and the seller is obliged to deliver the goods within that time. If no time is specified, the seller must deliver the goods within a reasonable time.

- Place of delivery: The place of delivery is also usually specified in the contract. If no place is specified, the goods must be delivered at the seller’s place of business or residence.

- Mode of delivery: The mode of delivery depends on the terms of the contract. The seller may be required to deliver the goods by a certain method, such as by courier, or the buyer may be responsible for collecting the goods from the seller’s premises.

- Risk of loss: The risk of loss passes from the seller to the buyer at the time of delivery. If the goods are lost or damaged during delivery, the party responsible for the loss will depend on the terms of the contract and the mode of delivery.

- Acceptance of goods: The buyer is required to accept the goods once they are delivered, unless they are defective or do not conform to the terms of the contract. If the buyer refuses to accept the goods, the seller may be entitled to damages or may be able to resell the goods to another buyer.

How to Download ECO-05 Solved Assignment?

You can download it from the www.edukar.in, they have a big database for all the IGNOU solved assignments.

Is the ECO-05 Solved Assignment Free?

Yes this is absolutely free to download the solved assignment from www.edukar.in

What is the last submission date for ECO-05 Solved Assignment?

For June Examination: 31st April, For December Examination: 30th October