Learn about the key differences between cash flow and fund flow, two important measures of a company’s financial health. Our blog explains the definitions, components, and purpose of each measure, as well as why it’s important to understand the difference.

Introduction

In any business, it is important to understand the flow of money. Cash flow and fund flow are two important financial terms that are used to describe how money moves in and out of a company. Both of these concepts are essential to a company’s financial health and must be managed effectively to ensure the business remains profitable.

Cash Flow

Cash flow is the net amount of cash and cash equivalents that flow in and out of a business during a specific period. It is an important measure of a company’s financial performance because it indicates how much cash the company has available to pay its bills and invest in future growth.

Components of Cash Flow Cash flow is typically divided into three components:

- Operating activities: This includes cash flows generated from the company’s core operations, such as sales, purchasing of inventory, and payment of salaries.

- Investing activities: This includes cash flows generated from buying or selling assets, such as equipment, property, or investments.

- Financing activities: This includes cash flows generated from the company’s financing activities, such as borrowing money, repaying loans, or issuing stock.

Fund Flow

Fund flow is a term used to describe the inflow and outflow of funds in a business. It is a broader term than cash flow as it includes not only cash but also other forms of funds, such as accounts receivable, accounts payable, and inventory.

Components of Fund Flow Fund flow is typically divided into two components:

- Sources of funds: This includes funds generated from the company’s core operations, such as sales revenue, accounts receivable, and accounts payable.

- Applications of funds: This includes funds used to pay for expenses, such as inventory, accounts payable, and loans.

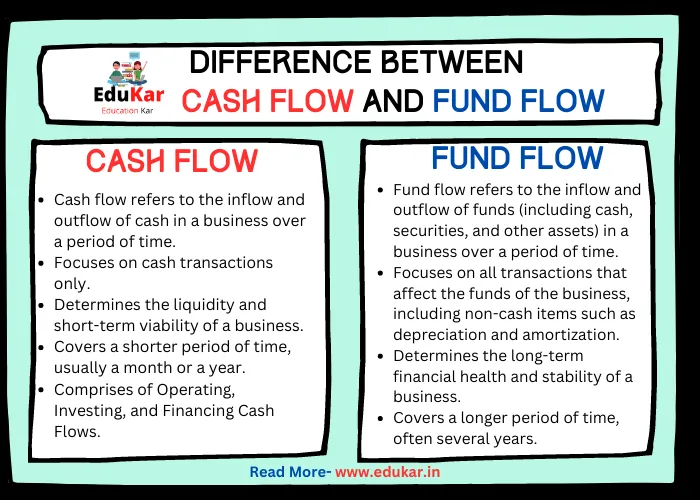

Differences between Cash Flow and Fund Flow

| S.No. | Cash Flow | Fund Flow |

|---|---|---|

| 1 | Cash flow refers to the inflow and outflow of cash or cash equivalents. | Fund flow refers to the inflow and outflow of funds, which includes both cash and non-cash items such as investments, securities, and other assets. |

| 2 | Cash flow is concerned with the liquidity of the business. | Fund flow is concerned with the financial position of the business. |

| 3 | Cash flow is a short-term concept. | Fund flow is a long-term concept. |

| 4 | Cash flow shows the actual cash transactions that have taken place during a period. | Fund flow shows the movement of funds in and out of the business, including non-cash items. |

| 5 | Cash flow can be positive, negative, or neutral. | Fund flow can only be positive or negative. |

| 6 | Cash flow is used for day-to-day activities, such as paying bills and salaries. | Fund flow is used for long-term investments and financing decisions. |

| 7 | Cash flow is calculated by subtracting cash outflows from cash inflows. | Fund flow is calculated by analyzing the changes in the balance sheet accounts. |

| 8 | Cash flow is more useful for short-term financial planning. | Fund flow is more useful for long-term financial planning. |

| 9 | Cash flow is affected by changes in accounts receivable, accounts payable, and inventory. | Fund flow is affected by changes in capital structure, dividends, and investments. |

| 10 | Cash flow is used to evaluate the ability of a business to generate cash. | Fund flow is used to evaluate the overall financial health and stability of a business. |

| 11 | Cash flow is more relevant for small businesses. | Fund flow is more relevant for large businesses. |

| 12 | Cash flow is influenced by short-term fluctuations in the market. | Fund flow is influenced by long-term trends in the market. |

| 13 | Cash flow is reported on the cash flow statement. | Fund flow is reported on the statement of changes in financial position. |

| 14 | Cash flow is more relevant for investors. | Fund flow is more relevant for creditors. |

| 15 | Cash flow is a simpler concept than fund flow. | Fund flow is a more complex concept than cash flow. |

Importance of Cash Flow and Fund Flow

Understanding the difference between cash flow and fund flow is essential for effective financial management. Both measures are critical for evaluating a company’s financial health and must be managed effectively to ensure the business remains profitable.

Cash flow is important for assessing a company’s liquidity and its ability to pay its bills. It is essential for financial management and is used by investors, creditors, and other stakeholders to evaluate a company’s financial performance.

Fund flow provides a broader view of a company’s financial health and is used to assess its ability to meet its financial obligations. It is an important tool for financial analysis and is used by investors, creditors, and other stakeholders to evaluate a company’s overall financial health.

Conclusion

Cash flow and fund flow are two important financial measures that are used to evaluate a company’s financial health. Although both measures are used to measure the flow of money in a business, they are used for different purposes.

Cash flow is important for assessing a company’s liquidity and its ability to pay its bills, while fund flow provides a broader view of a company’s financial health and is used to assess its ability to meet its financial obligations. Understanding the difference between cash flow and fund flow is essential for effective financial management and must be managed effectively to ensure the business remains profitable.

FAQs related to Cash Flow and Fund Flow for Exams

What is Cash flow?

Cash flow refers to the movement of cash and cash equivalents in and out of a business. It measures the amount of cash that a company generates or uses in its operations, investments, and financing activities.

What is Fund flow?

Fund flow is a broader measure of the flow of funds in a business. It includes not only cash but also other assets and liabilities, such as accounts receivable, accounts payable, and inventory. Fund flow statements provide an overview of the sources and uses of funds in a business.

What are the components of cash flow?

Cash flow is typically divided into three components: operating activities, investing activities, and financing activities. Operating activities refer to the cash flows generated by a company’s core business operations, while investing activities relate to the cash flows used to acquire or dispose of long-term assets. Financing activities refer to the cash flows generated or used to raise or repay capital.

What are the components of fund flow?

Fund flow is typically divided into two components: sources of funds and applications of funds. Sources of funds include the cash flows generated by a company’s operations, as well as any external financing received. Applications of funds include the cash flows used to acquire assets or repay debts.

What is the purpose of cash flow?

The purpose of cash flow is to measure a company’s ability to pay its bills and invest in future growth. It is an essential tool for financial management and is used by investors, creditors, and other stakeholders to evaluate a company’s financial performance.

What is the purpose of fund flow?

The purpose of fund flow is to evaluate a company’s overall financial health and to assess its ability to meet its financial obligations. It provides a broader view of a company’s financial health than cash flow and is used by investors, creditors, and other stakeholders to evaluate a company’s overall financial health.

Who uses cash flow and fund flow statements?

Cash flow and fund flow statements are used by a variety of stakeholders, including investors, creditors, financial analysts, and management. They provide important insights into a company’s financial performance and are used to make informed investment and lending decisions.